2025–2026 Winter Reliability Assessment Western Overview

- The Winter Reliability Assessment (WRA) covers the upcoming winter season, providing an evaluation of reliability for projected risk periods.

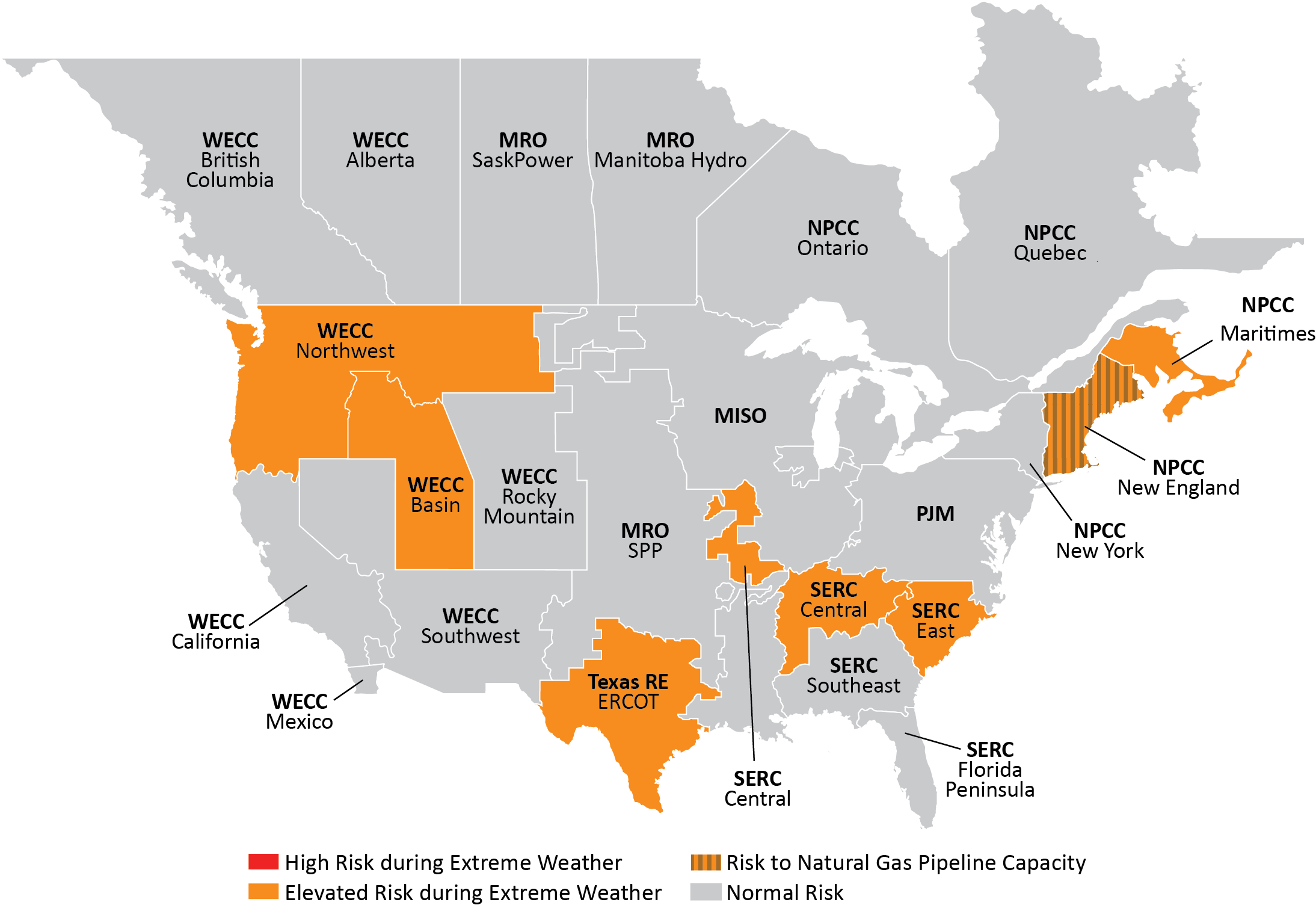

- Much of the Western Interconnection is expected to be at normal risk this winter, with operating reserves sufficient for meeting normal peak load conditions.

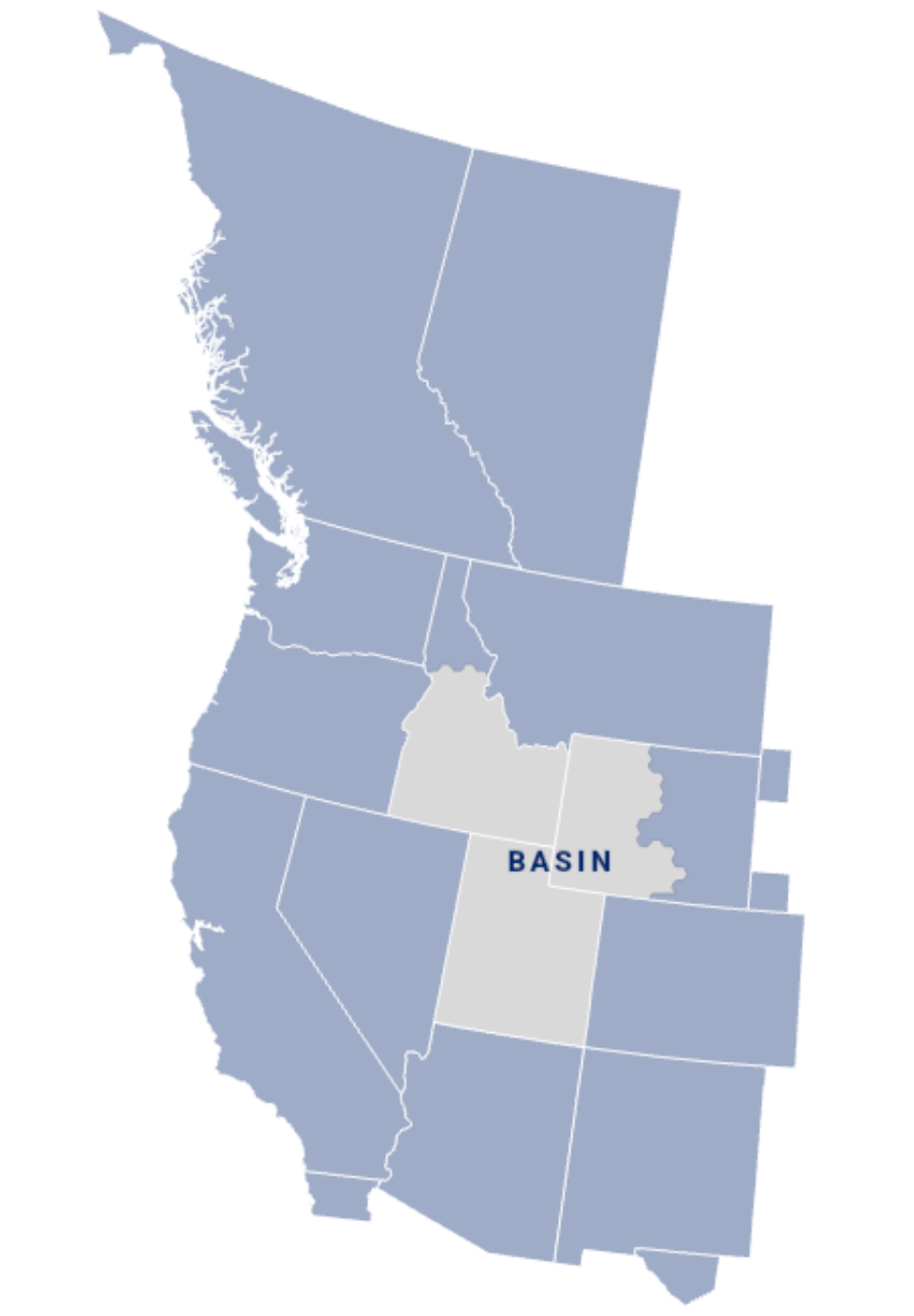

- Two subregions, Northwest and Basin, are expected to be at an elevated risk of electricity shortfalls during potential extreme weather this winter.

- Cold weather Reliability Standards introduced in 2023 have been improved to address recommendations from Winter Storms Elliott and Uri.

- Natural gas production and supply infrastructure performance during the winter conditions of the highest risk periods could have a significant impact on reliability.

NERC Winter Reliability Assessment: Western Overview

Each year, WECC partners with the North American Electric Reliability Corporation (NERC) and Electric Reliability Organization (ERO) Enterprise to develop the NERC WRA. This assessment evaluates system resource adequacy and reliability across North America for the upcoming winter season. Below are highlights from the assessment specific to the Western Interconnection.

- The NERC 2025–2026 Winter Reliability Assessment found that all areas have adequate resources for normal peak load conditions this winter.

- Extreme winter conditions extending over a wide area could result in resource adequacy issues in two subregions: Basin and Northwest. The Northwest is expected to be able to sufficiently meet demand through imports, but Basin could find insufficient imports available to meet demand during a wide-area weather event.

- Natural gas is essential for maintaining reliability in winter. Yet winter conditions can also be the most challenging for natural gas generation, as its production tends to be reduced in extreme cold, supply infrastructure can be affected by issues related to freezing, and generators without secure firm fuel contracts may be unable to get fuel.

- Cold weather reliability standards have been improved to address recommendations from Winter Storms Elliott and Uri, and there has been improved coordination between the electric and natural gas systems, particularly in the Northwest, since the winter storm that hit on Martin Luther King Jr. holiday weekend in January 2024.

Subregion Reliability Highlights

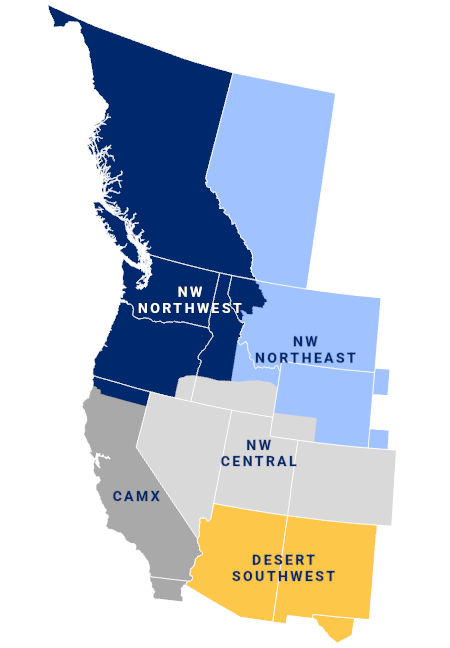

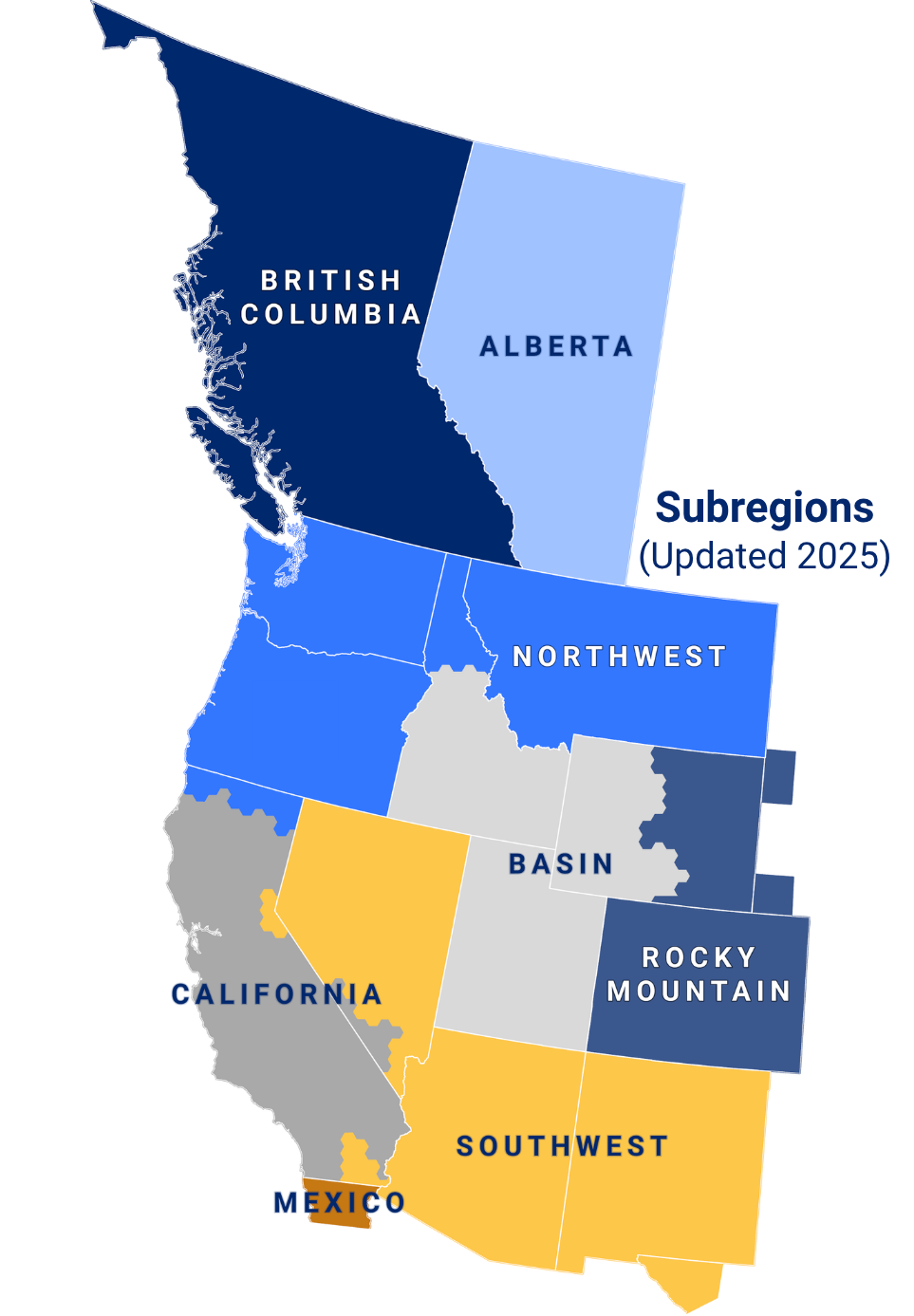

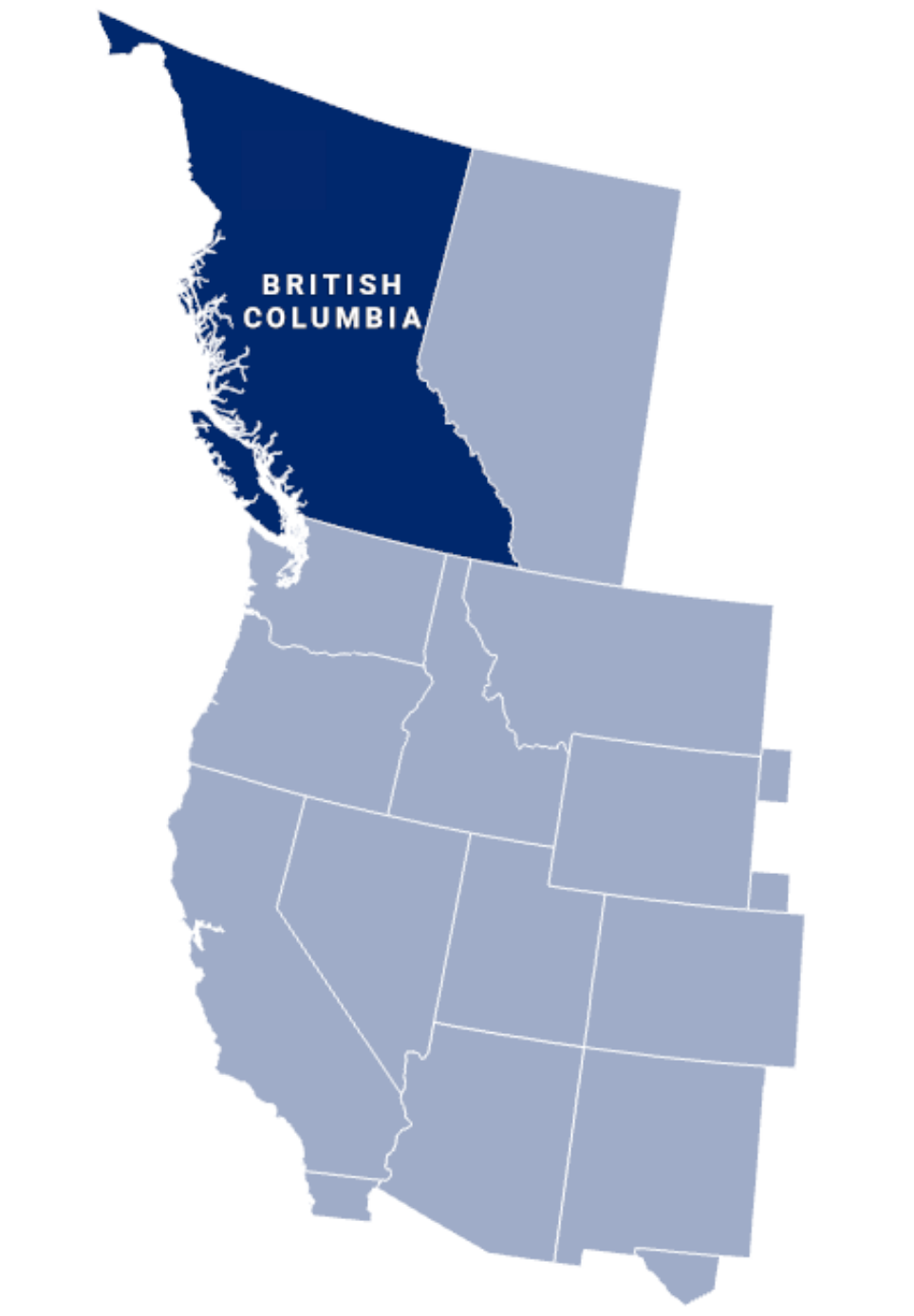

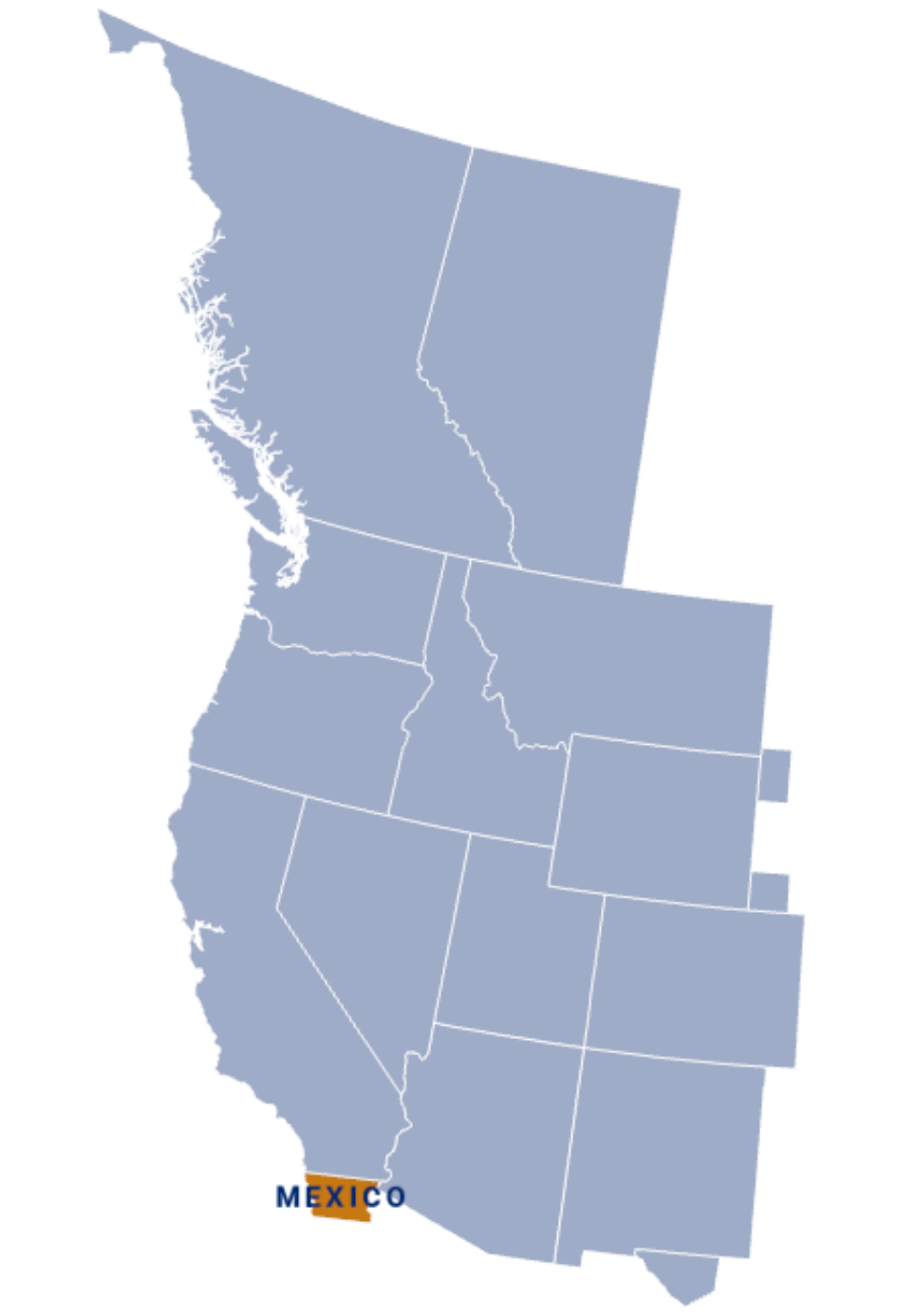

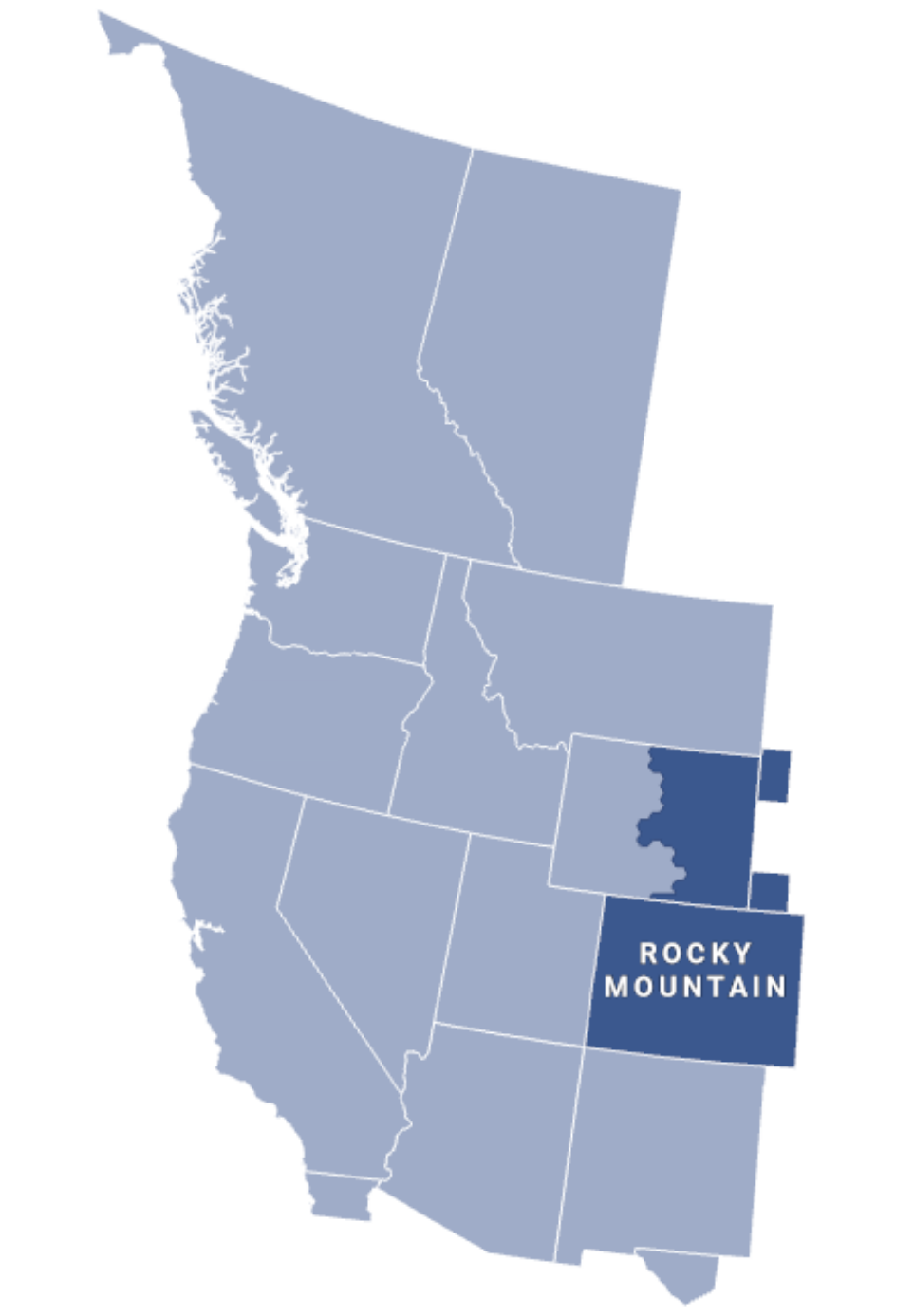

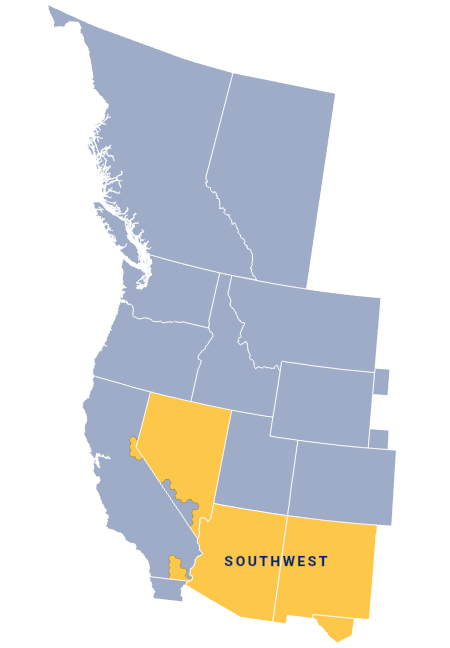

Revised Subregions: WECC divides the Western Interconnection into subregions to analyze resource adequacy and reliability risk at many levels. This year, WECC adopted new subregional boundaries that more accurately reflect operational and planning realities, as well as the footprints of various entities. These new boundaries were used in the WRA.

British Columbia: Peak demand is expected to be roughly the same as last winter in this winter-peaking subregion. Solar nameplate capacity has increased from 2 MW to 17 MW, and hydro capacity is up 5.4% or 1,366 MW. No reliance on imports is expected for reliability.

Alberta: Demand is expected to increase 1% from last winter in this winter-peaking subregion, while the installed capacity has increased 23% since last winter, primarily natural gas.

Northwest: Demand is forecast to increase 9.3% this winter. Retirements of coal and hydro generation have led to a reduction in capacity, but more than 3 GW of new generation has been in development this year, mainly battery storage, solar, and wind. While there is sufficient generating capacity to meet expected peak demand, Balancing Authorities are likely to rely on energy imports during extreme winter weather that can cause thermal plant outages and curtail wind output.

California: Peak demand is expected to be the same as last winter, and 2.5 GW of new resources have been added to boost capacity by about 5%. Nameplate wind capacity is up almost 27% and solar is up almost 13%. No reliance on imports is expected to be required to maintain resource adequacy.

Mexico: Peak demand is expected to be roughly the same as last winter in this summer-peaking subregion. Although the anticipated reserve margins are down by nearly 8%, the subregion's 83% reserve margin still exceeds the reference margin level of 12.5%. No reliance on imports is expected to be required to maintain resource adequacy this winter.

Basin: Demand is expected to increase 1% since last year. About 7 GW of new wind, solar, and storage were brought online in 2024 and 2025 and is expected to be available this winter. While there is sufficient generating capacity to meet expected peak conditions, a reliance on imports is expected during extreme winter weather due to the potential for plant outages, diminished wind generation, and natural gas fuel supply constraints. However, during a wide-area extreme weather event, there may not be sufficient energy imports available to meet demand.

Rocky Mountain: Demand has increased 1.1% since last winter. Solar nameplate capacity is up 27%, but peak solar availability is down significantly due to the early sunset in winter, and hydro availability is down by around 25% on the peak hour. Still, no reliance on imports is expected to be required to maintain resource adequacy.

Southwest: Demand is up 2.3% since last winter. Nameplate wind capacity is up 12% and solar has increased 27%. No reliance on energy imports is expected.

Winter Conditions Affecting the Bulk Power System

Extreme weather remains a top concern for the West. Seasonal forecasts indicate above-normal temperatures for the south and below-normal precipitation conditions for the north. To learn more about the expected winter weather and operating conditions, view the Reliability in the West Discussion Series: Winter Outlook.

Temperature Forecast: Dec. '25–Mar. '26

Precipitation Forecast: Dec. '25–Mar. '26

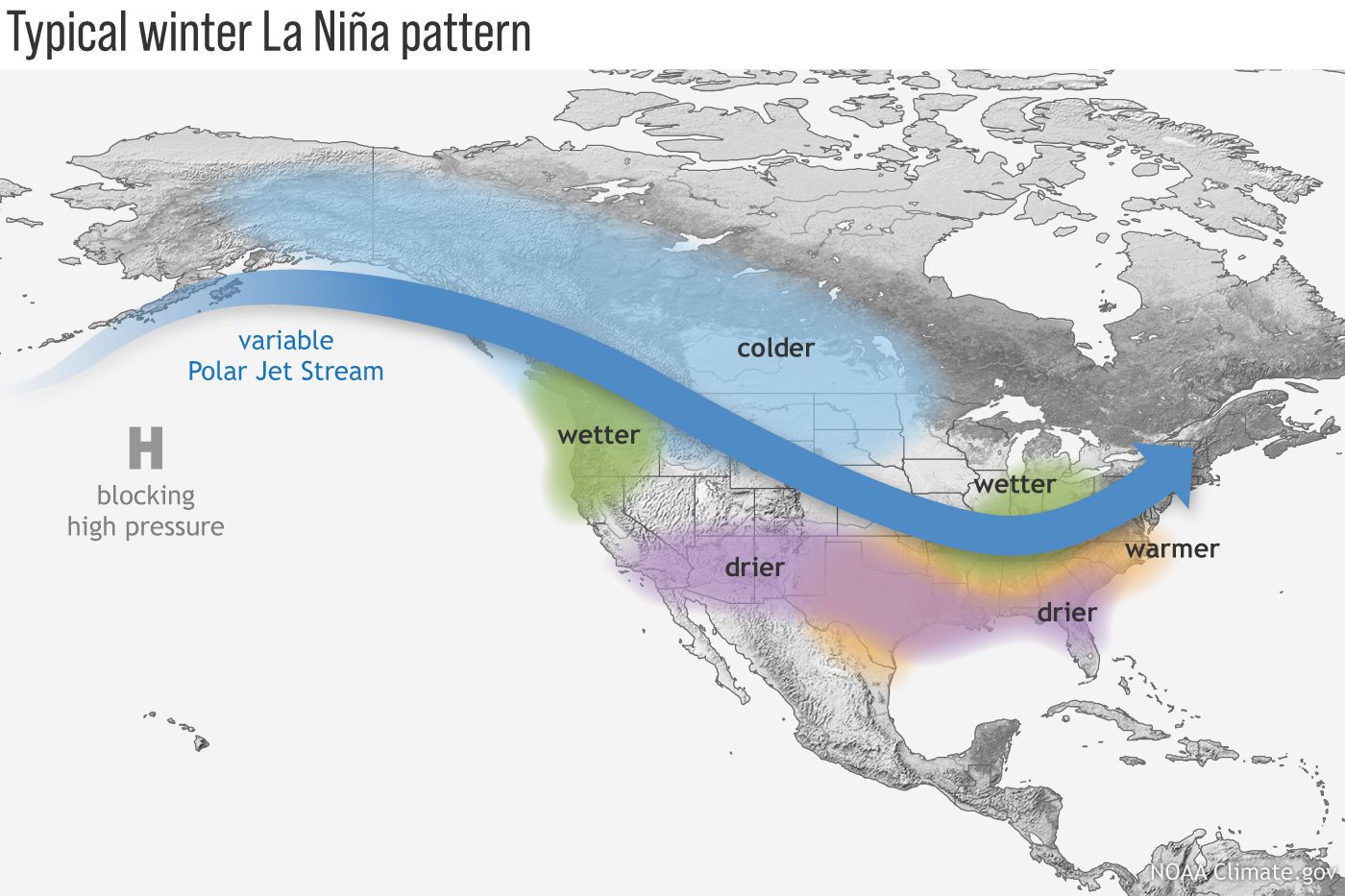

Above: During La Niña, the Pacific jet stream often meanders high into the North Pacific. Southern and interior Alaska and the Pacific Northwest tend to be cooler and wetter than average, and the southern tier of U.S. states—from California to the Carolinas—tends to be warmer and drier than average.

Above: During La Niña, the Pacific jet stream often meanders high into the North Pacific. Southern and interior Alaska and the Pacific Northwest tend to be cooler and wetter than average, and the southern tier of U.S. states—from California to the Carolinas—tends to be warmer and drier than average.

Winter Outlook

Warmer than normal conditions expected across the southern portion of the Western Interconnection, while colder conditions are forecast in the Northwest. Much of the Basin subregion is forecast to have equal chances of below-, near- or above-average temperatures this winter.

The seasonal outlook is influenced by the presence of a weak La Niña, which is expected to continue through February 2026. That could lead to increased precipitation and colder temperatures in Alberta, British Columbia, the Pacific Northwest, and northern California. Additionally, a weak polar vortex could disrupt the jet stream, leading to variable temperature cycles.

Above: U.S. surface map animation from January 14-17, 2024 showing the progression of the Arctic cold front and surface high pressure.

Above: U.S. surface map animation from January 14-17, 2024 showing the progression of the Arctic cold front and surface high pressure.

Extreme Weather

Extreme weather not only drives up demand for electricity, it also can impact generation. When these conditions persist for several days, that can lead to problems.

A winter storm that hit the interconnection January 14–17, Martin Luther King Jr. holiday weekend 2024 was both widespread and long-lasting, primarily affecting three subregions—the Northwest, Alberta, and British Columbia. Electricity demand reached record levels at utilities in all three subregions, leading to reliability challenges. Several utilities in the Northwest subregion declared energy emergencies outside of the peak demand periods and relied on imports from other subregions. In Alberta, record-high demand combined with low wind generation and unexpected generation outages led to several energy emergency alerts being issued. No load was lost due in part to an emergency alert asking residents to limit non-essential electricity use.

Electric-Natural Gas Interface

While winter 2024–2025 did not produce a serious weather-driven threat to reliability in the West, the storm that hit over the Martin Luther King Jr. holiday weekend in 2024 has brought increased attention to the importance of coordination between natural gas and electric systems. Natural gas is essential for maintaining reliability in winter, but extreme winter conditions can be the most challenging for natural gas generation. As the resource mix evolves, it is important to understand how the electric and gas systems work together to ensure the reliable operation of the bulk power system. To learn more, view the Reliability in the West Discussion Series: Natural Gas-Electric Interdependence.

The Independent Voice of Bulk Power System Reliability in the Western Interconnection