State of the Interconnection 2025

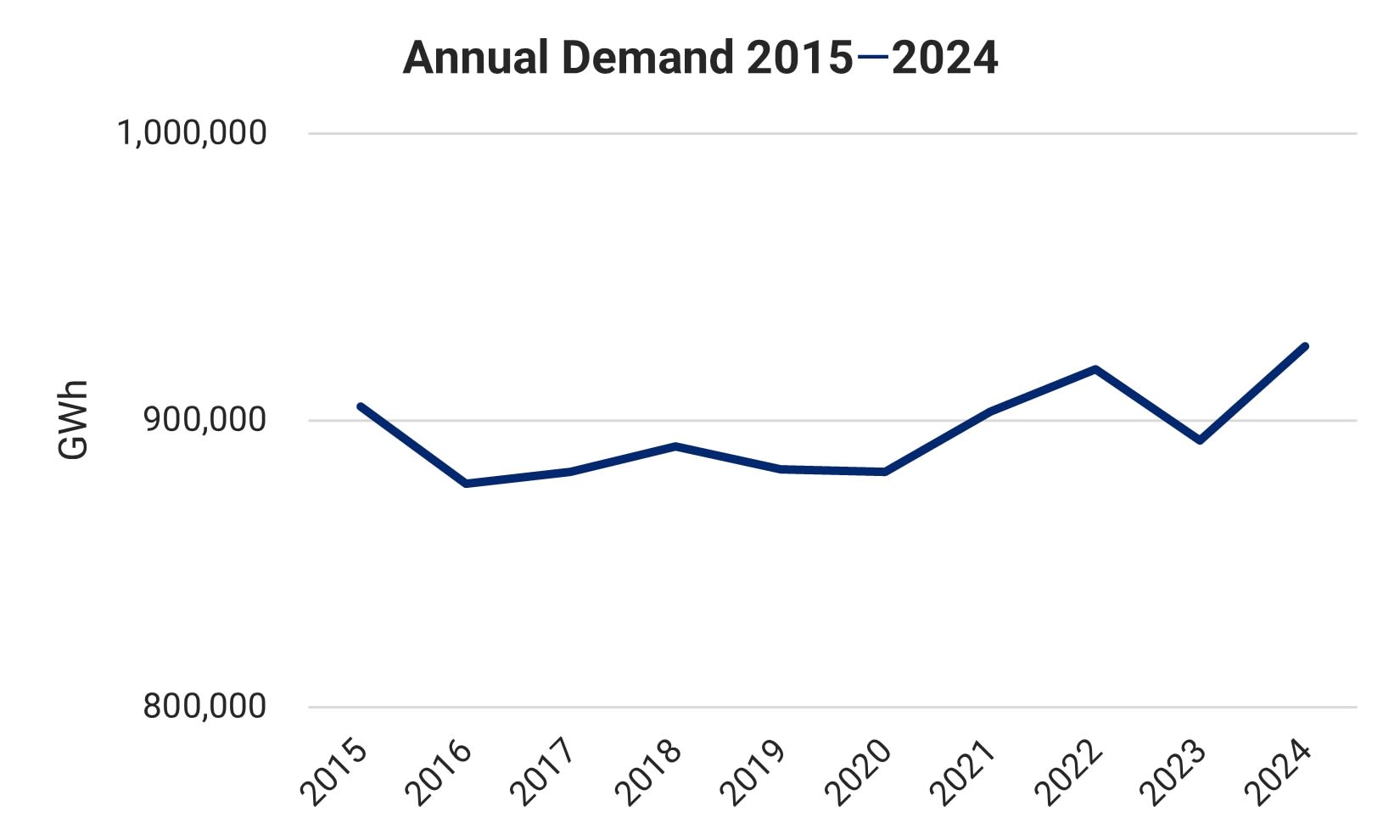

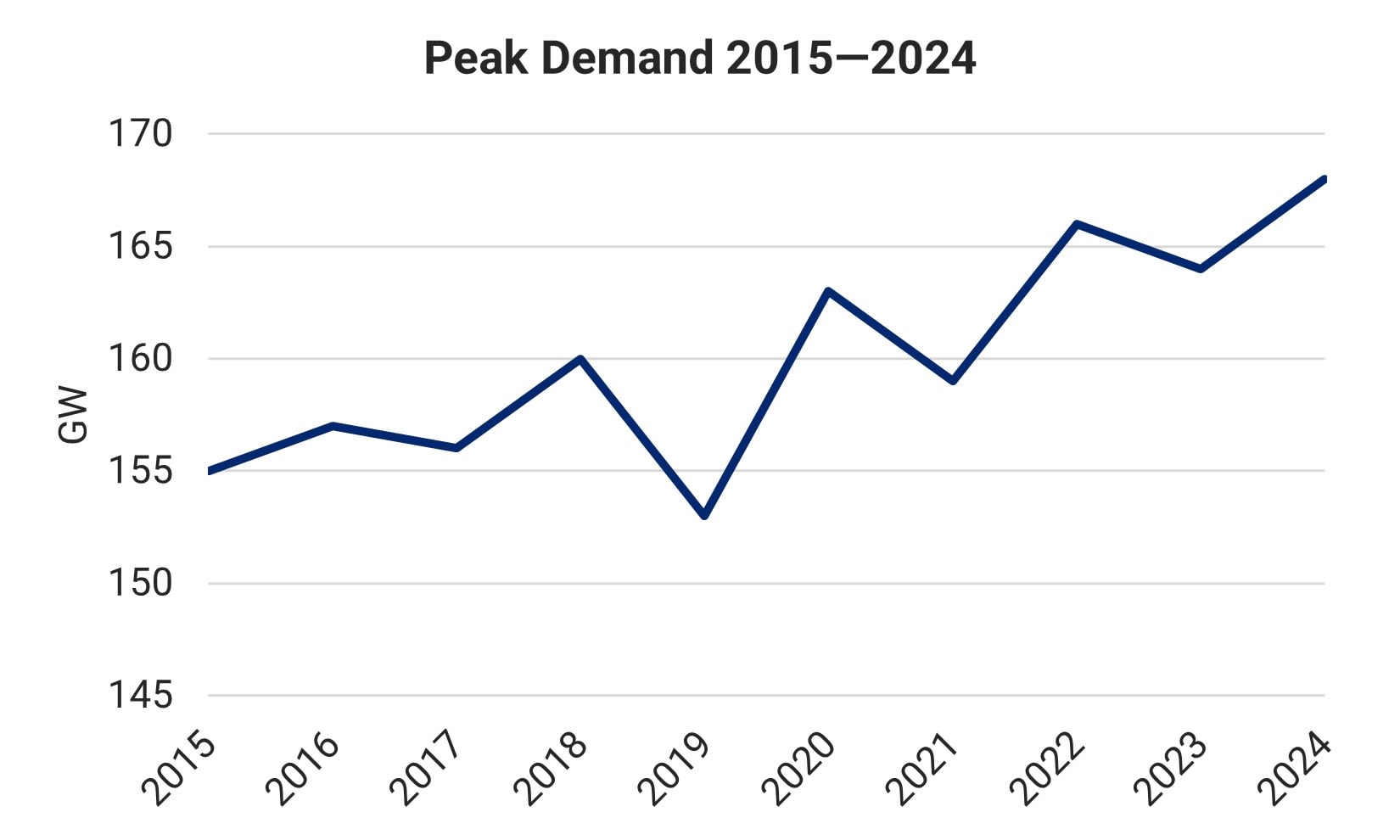

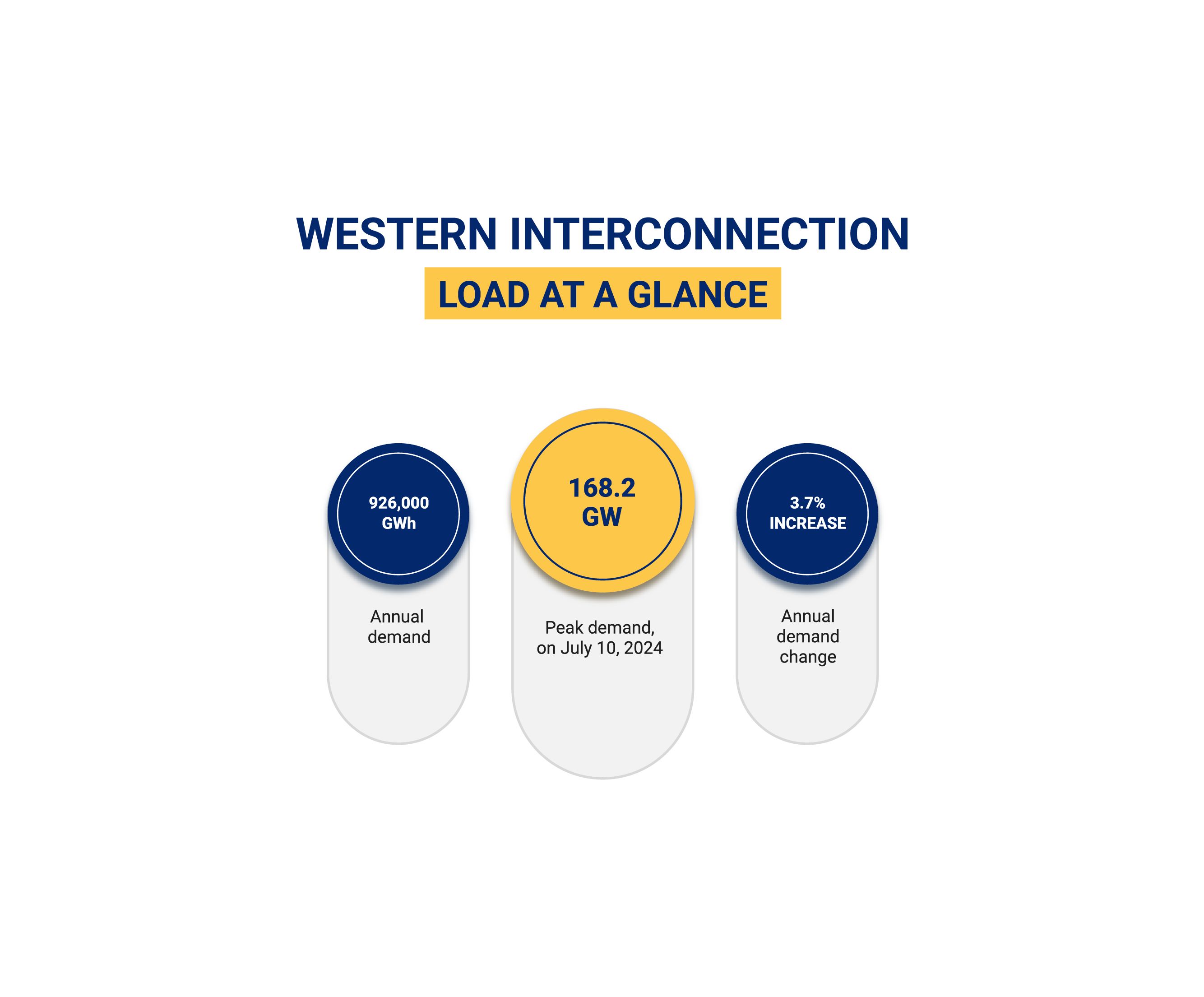

Load growth is a primary driver of power system planning and an important factor to consider in evaluating system performance. In 2024, the Western Interconnection broke records for both annual demand and peak demand.

- 2024 annual demand was 926,000 GWh, surpassing the previous record of 918,000 GWh set in 2022.

- Peak demand was 168.2 GW in 2024. The West has broken peak demand records in three of the last five years (2020, 2022, 2024).

The sharp increase in annual demand in 2024 reflects some early effects of large load development. As the development of large loads grows, particularly data centers, forecasting accuracy will become increasingly critical. There is high uncertainty about future large loads, which makes planning for them difficult. The West must find a way to deal with this uncertainty to plan an adequate system.

Historical Demand

In 2024, the Western Interconnection reached an all-time high annual demand of 926,000 GWh. This was an increase of 3.7% over 2023's annual demand of 893,000 GWh. The increase in annual demand between 2023 and 2024 is greater than any single-year increase in the last decade and far surpasses the annual average growth rate of 0.4% over the last 10 years.

Peak demand in the Western Interconnection has increased 8.5% in the last 10 years, from 155 GW in 2015 to 168.2 GW in 2024. Set on July 10, 2024, this is a record high for the Western Interconnection. Record peak demand highs have been set in five of the last 10 years.

Large Loads

The interconnection is already experiencing the effects of large loads. The magnitude of the annual demand increase in 2024 reflects the early effects of new large loads and increased uncertainty. Demand growth is higher today than at any other time in the last 20 years. In 2024, WECC partnered with Elevate Energy Consulting to create the Assessment of Large Load Interconnection Risks in the Western Interconnection. The report points out several challenges associated with large loads:

- Modeling challenges in representing the dynamics of large load behavior

- Planning challenges associated with different timelines for adding large load, resources, and transmission

- Data challenges with predicting how many of the planned large loads will come to fruition

- Operational challenges with large load demand fluctuations

- Lack of well-defined interconnection requirements

Arizona Public Service contends with influx of large loads

Arizona has become a hub for large loads in recent years. Arizona Public Service (APS), the state’s largest electric utility, has experienced this trend firsthand. The utility expects its annual energy needs to grow by almost 24 GWh between 2023 and 2038, with almost 80% of that growth tied to data centers and large industrial and manufacturing facilities, particularly in the semiconductor chip manufacturing industry.

Although there is some uncertainty regarding the rate of growth, APS projects that its annual peak demand will grow by nearly 40% from 2023 to 2031. This poses challenges to APS in both operations and planning.

APS plans to meet this future demand by using current and new resource technologies that balance reliability and affordability with increasingly clean energy resources. Even with current forecasts that show additional customer on-peak resources of more than 750 MW of distributed solar generation and 1,300 MW of energy efficiency by 2038, APS expects it will need to add more than 12,000 MW to meet peak load requirements over this period.

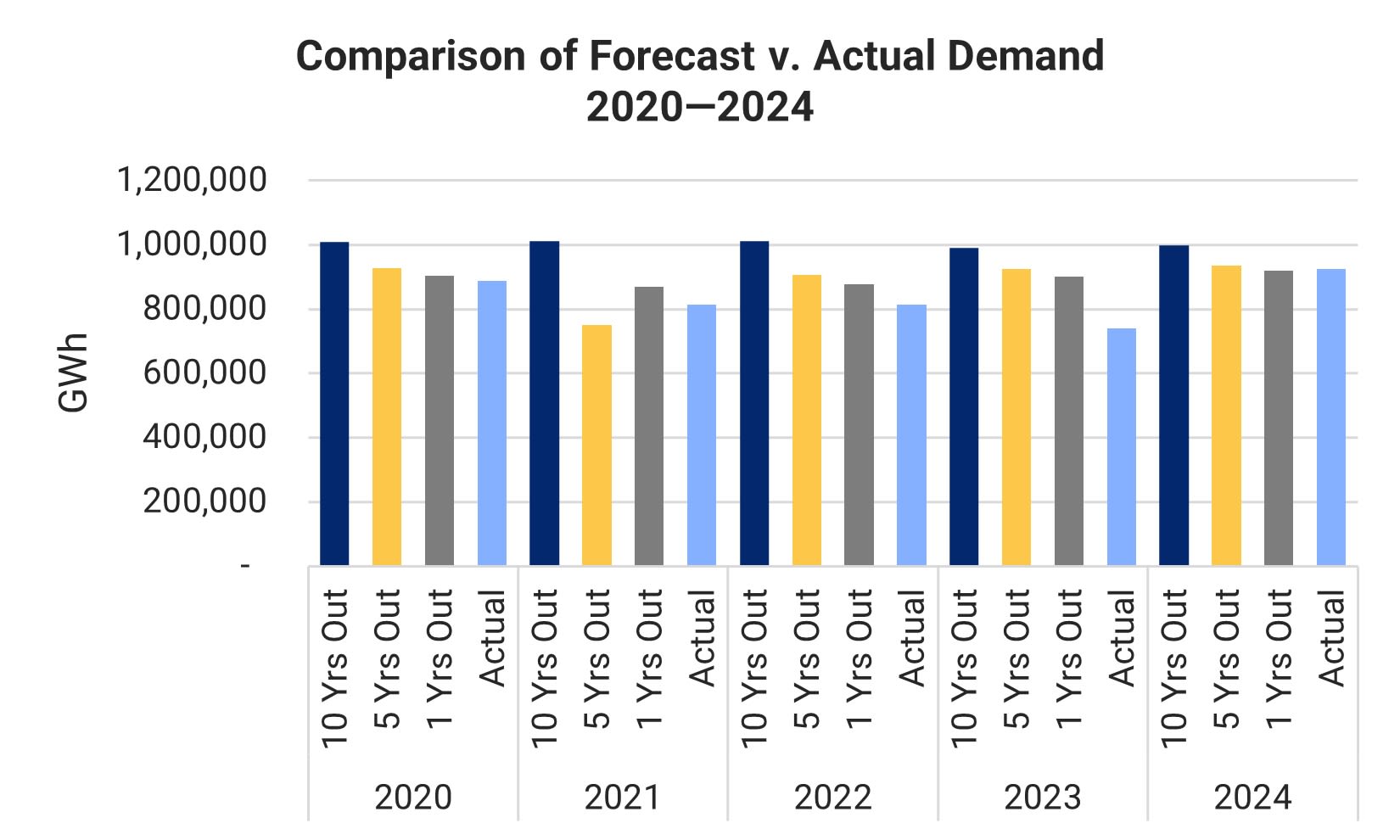

Demand Forecasting Accuracy

Over the last five years, annual demand forecasts have been relatively close to actual demand when aggregated to the interconnection-wide level. Ten-year forecasts are typically more conservative, tending toward overestimating demand, and as the operating year nears, demand forecasts improve. However, at the individual Balancing Authority (BA) level, there is a significant range in the accuracy of forecasts. A review of demand forecasting accuracy showed one BA's forecasts averaged 32% over its actual demand for all forecast years, while another BA's forecasts were only 5% over actual demand. In some cases, BAs forecast less than the actual demand they experienced.

While the range in forecasting accuracy at the BA level is smoothed out at the interconnection-wide level, it could be a concerning indicator that demand forecasting practices vary widely. Historically, annual demand growth has been fairly predictable; however, annual demand is forecast to grow at an unprecedented rate over the next decade, increasing by 20%. Large loads and electrification, and changing weather and climate patterns, drive load changes, increase uncertainty, and create challenges to forecasting load. This can affect the lead time available to plan and build new resources and transmission, making improved forecasting critical to alleviating the risk of energy inadequacy.