2025 Western Assessment of Resource Adequacy

WECC's annual Western Assessment of Resource Adequacy provides a high-level examination of risks to the reliability of the Western Interconnection related to resource adequacy over the next 10 years. Through an energy-based probabilistic approach, WECC examines the risks throughout the entire interconnection and eight subregions, across all potential hours at risk (unlike traditional peak load hour assessments). This work is intended to help stakeholders target specific areas and topics for deeper evaluation and mitigation.

The West's planned resource buildout will not keep up with anticipated load growth over the next decade, particularly in the Basin and Northwest subregions. The West could see energy shortfalls as early as 2028.

This is the case even with an incredibly high amount of resource additions planned over the next 10 years, approximately half of which are speculative. Any delay or cancellation of planned resource additions would exacerbate the resource adequacy risk.

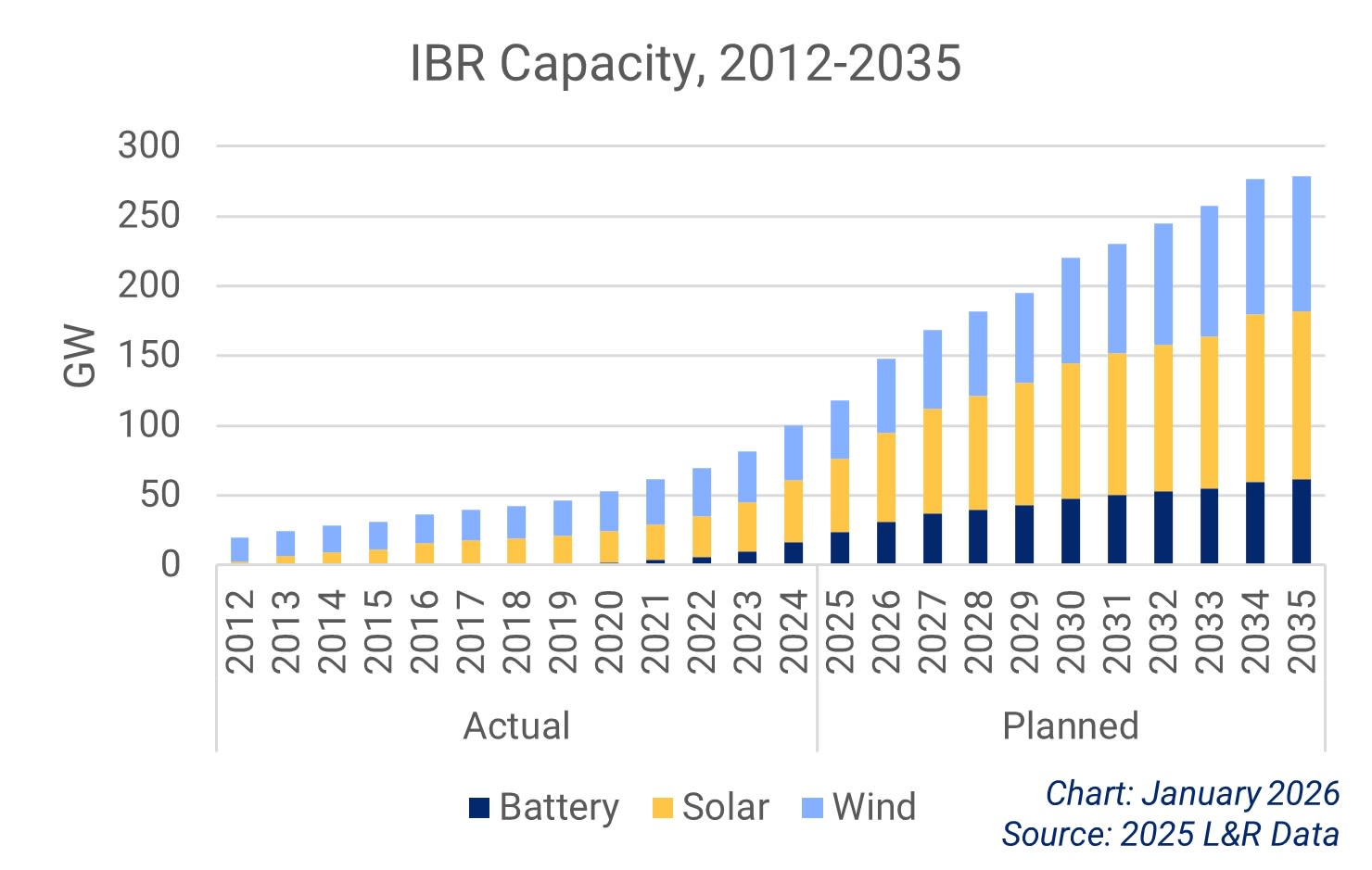

Further complicating the risk, 90% of planned additions are inverter-based resources. So, while it seems 177 GW of new resources should be able to serve 31 GW of projected load growth, most of the new resources are weather dependent, which creates uncertainty.

Much of the load growth is attributed to large loads. While there is uncertainty about whether large loads will materialize as predicted, even if some large loads do not, there is still a resource adequacy risk.

Western Interconnection Subregional

Resource Adequacy Risks

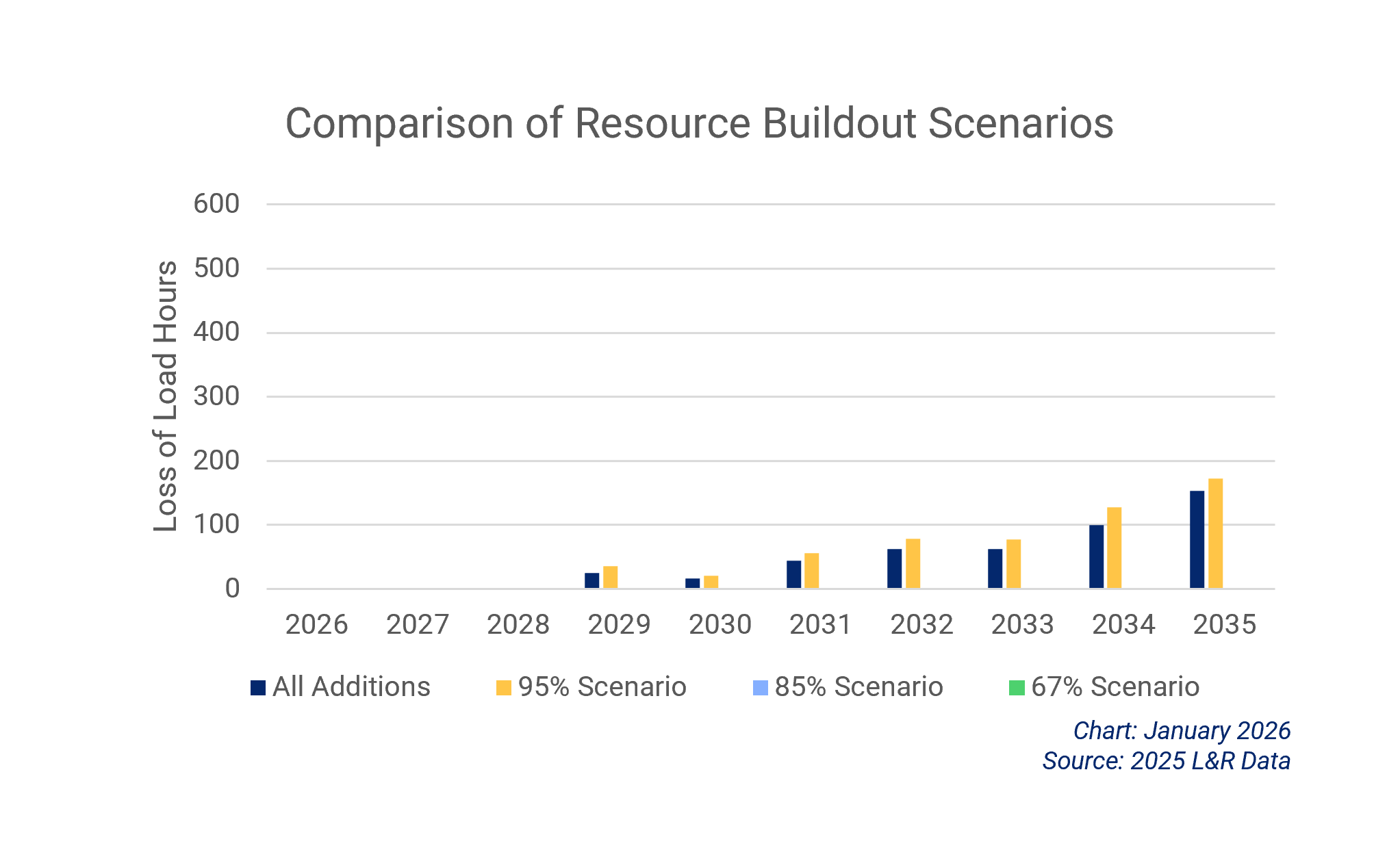

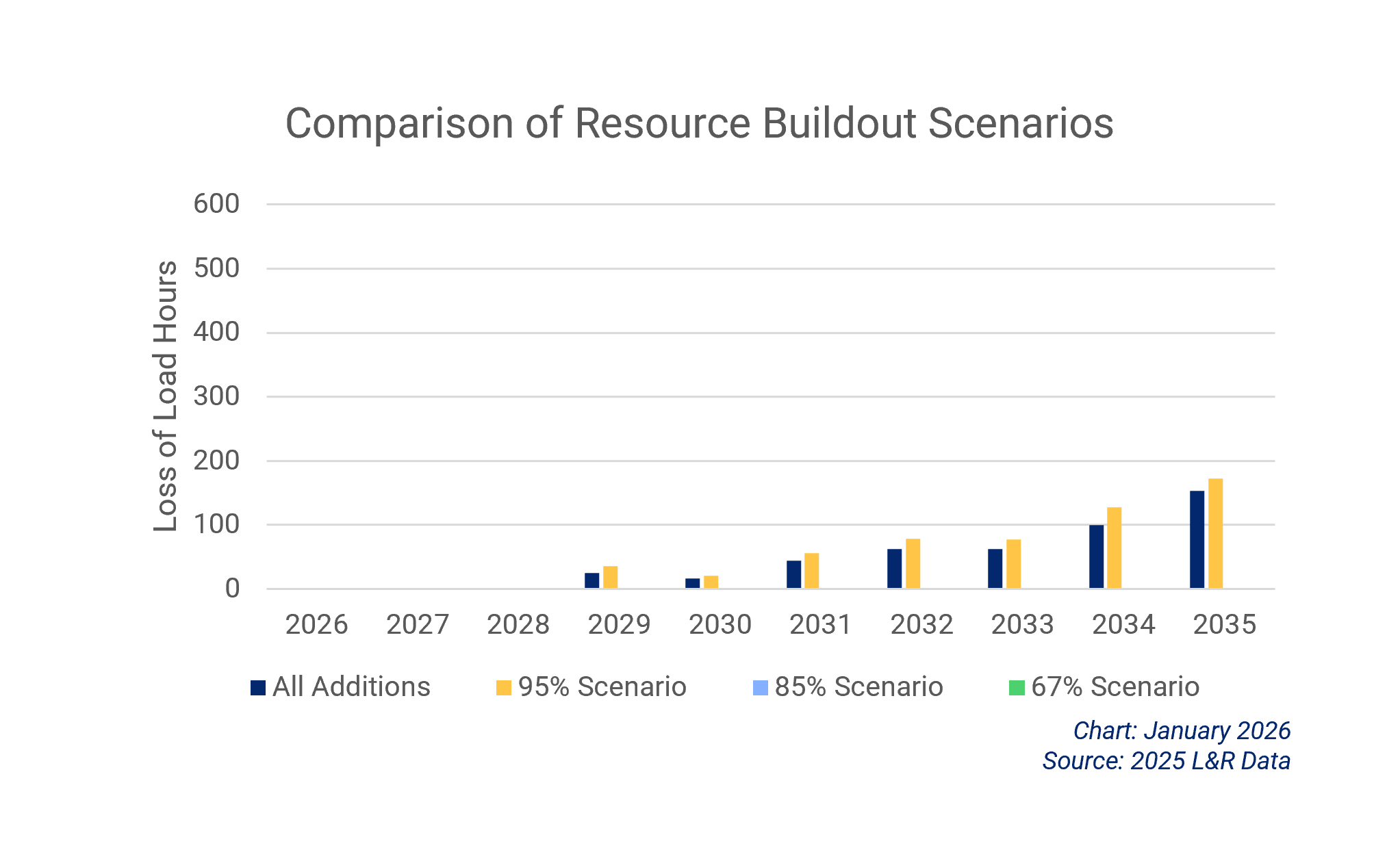

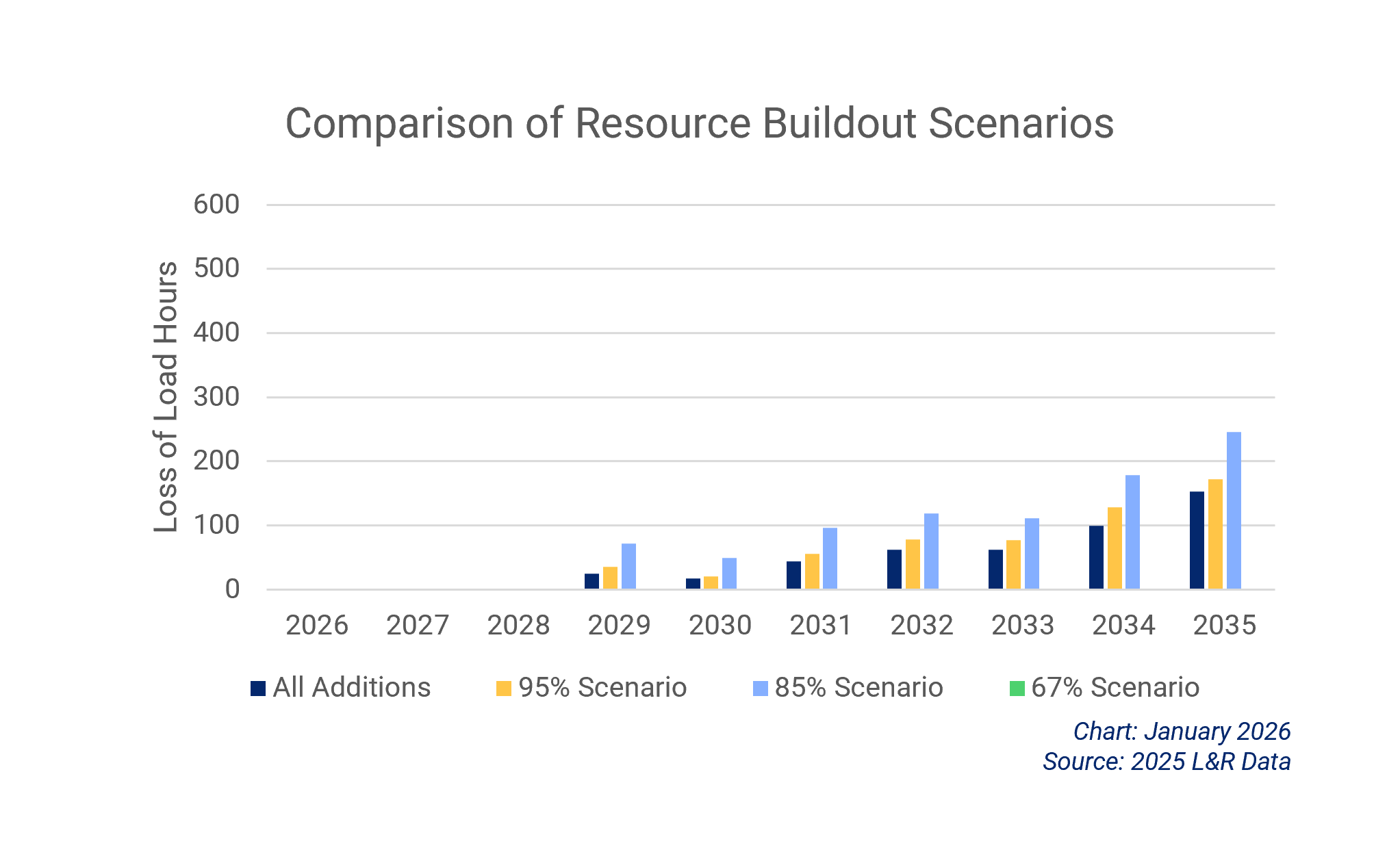

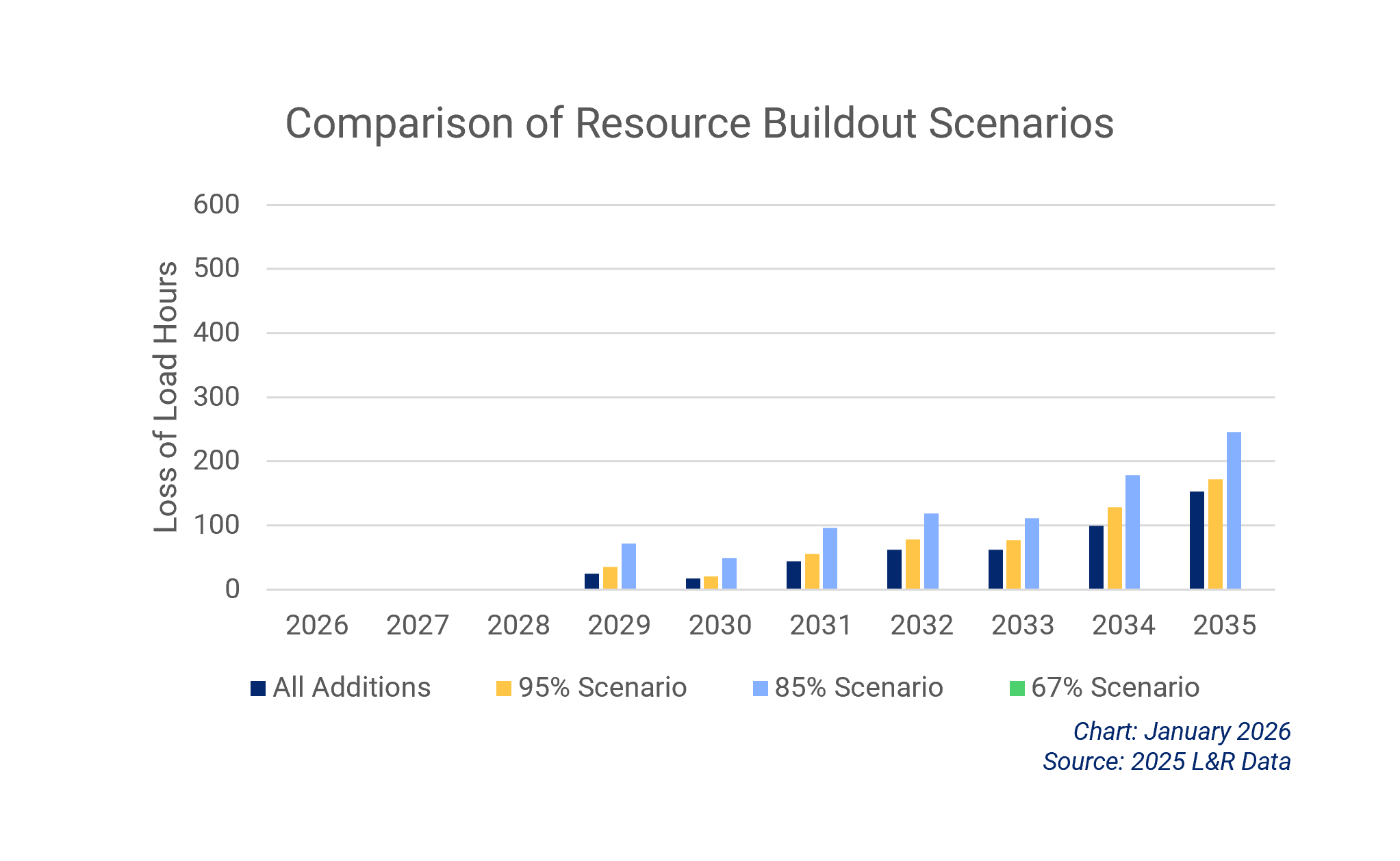

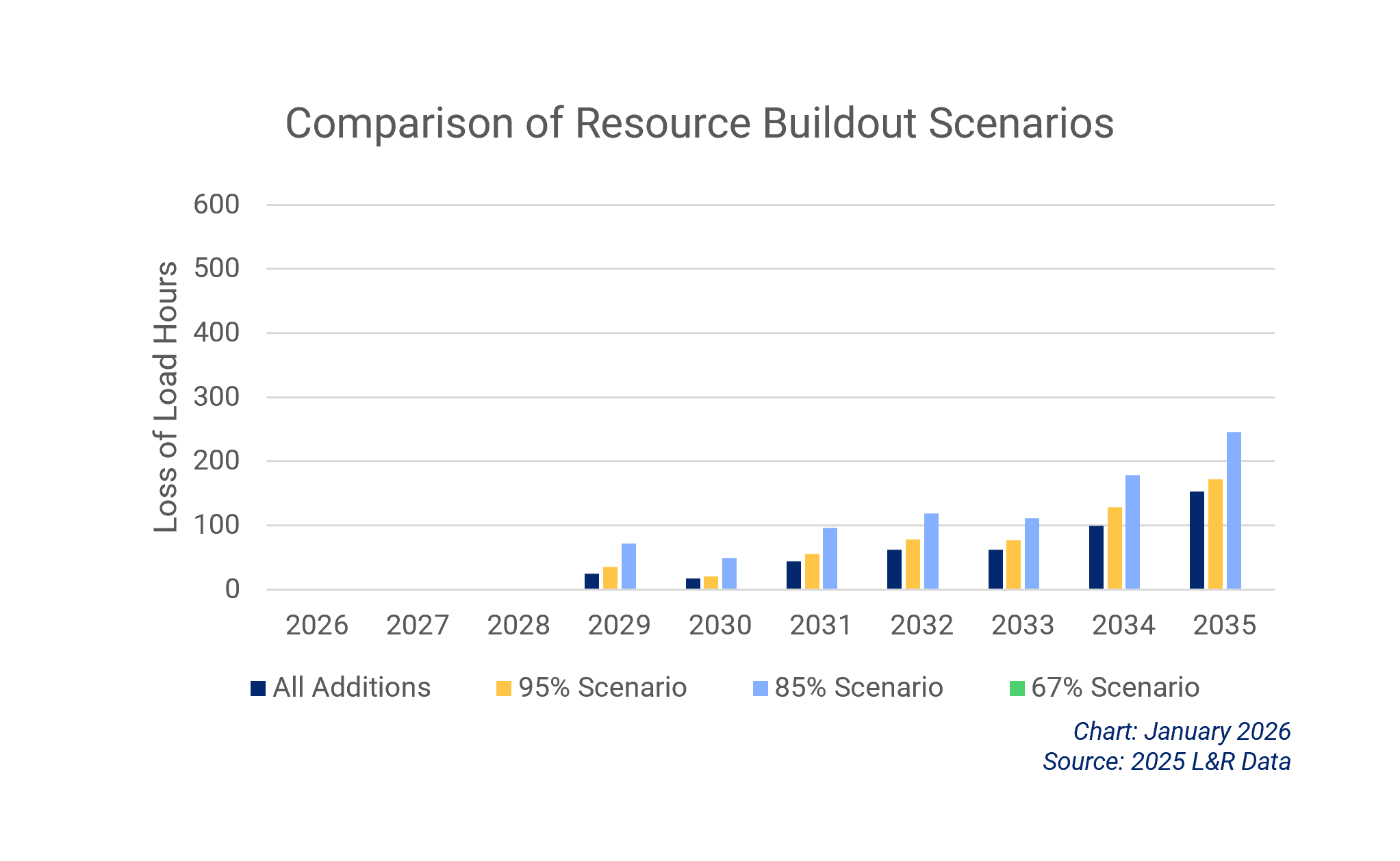

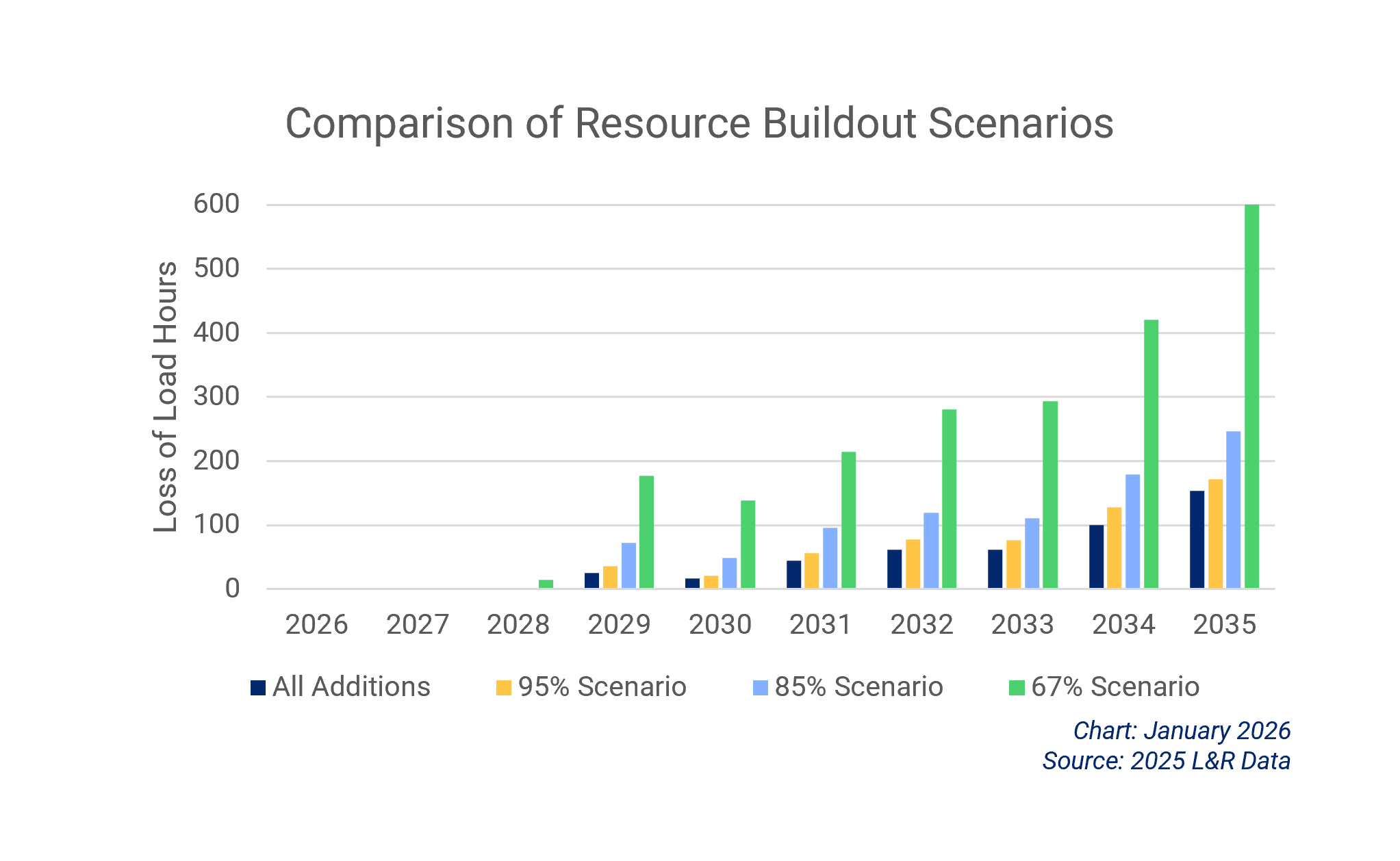

Resource Scenario Analysis

The West's planned resource buildout will not keep up with anticipated load growth over the next decade, particularly in the Basin and Northwest subregions.

If planned resource additions are delayed or canceled, the reliability risk becomes greater and spreads to other subregions.

Resource Buildout

Entities in the Western Interconnection plan to add 177 GW of new resources over the next decade. Historically, the number of new resources built according to plan and on time has varied. WECC's analysis found that in 2024, 80% of planned resources came online as scheduled. In 2023, approximately 53% of planned resources were added on time, and the three-year average (2022–2024) of resources that become operational in the year planned is 67%. Even though the planned capacity additions are significant, it is unlikely that everything planned will be built as planned, creating the chance of a shortfall.

Resource Scenarios

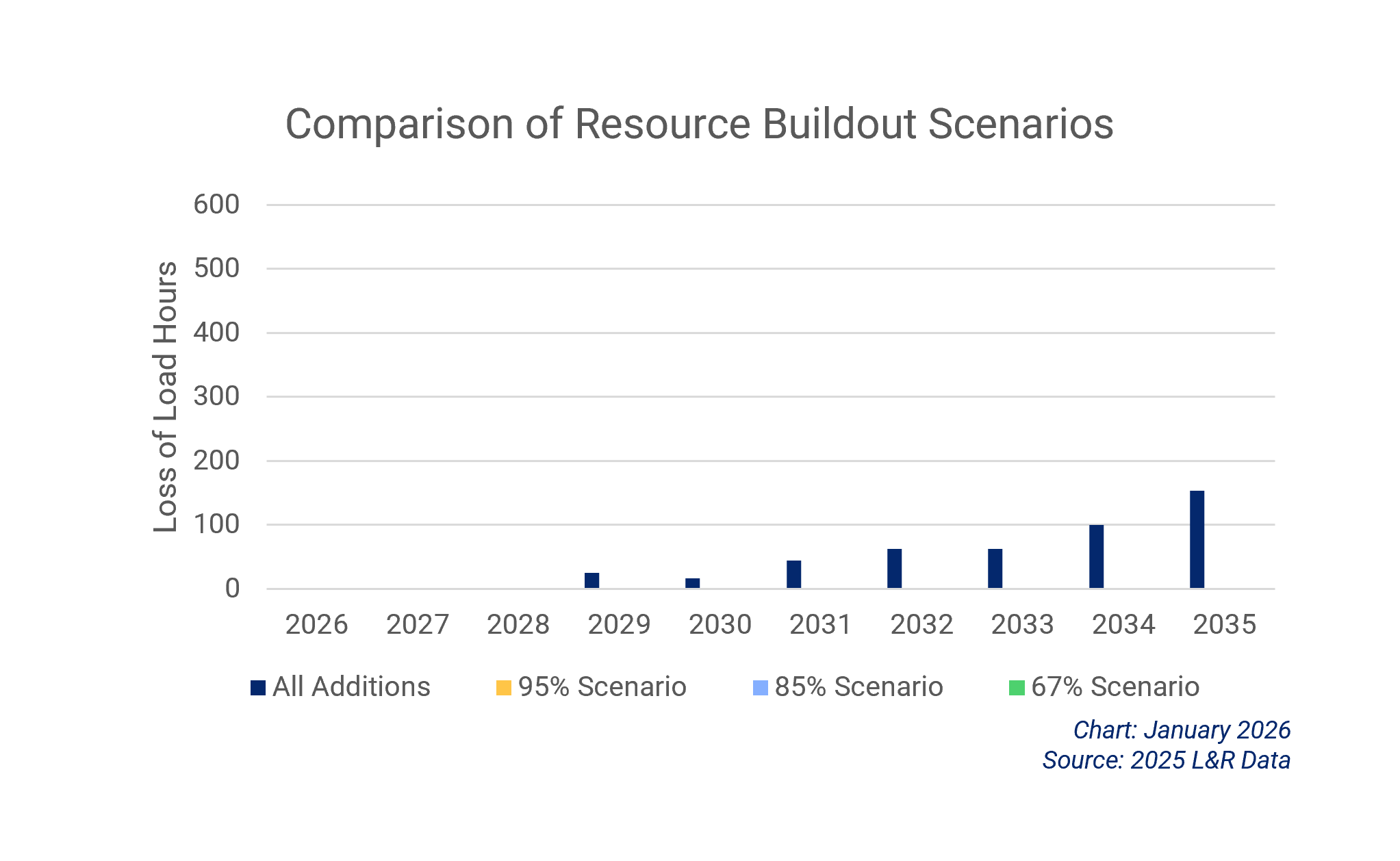

To assess the impact of failing to add generation as planned, WECC evaluated four scenarios:

- All planned resources are built on time

- 95% of planned resources are built on time

- 85% are built on time

- 67% are built on time

All Additions Scenario

Even if all planned additions are completed and operational on time, WECC's analysis found loss of load every year beginning in 2029 and continuing through the end of the decade for a total of 463 LOLH over the 10-year period studied. Two subregions saw loss of load in this scenario; as a result, they are at Elevated Risk for resource adequacy shortfalls over the coming decade:

- Northwest: 445 LOLH over 10 years

- Basin: 18 LOLH

95% Scenario

In this scenario, there was slightly more loss of load than in the All Additions Scenario, as expected: 568 hours vs. 463 hours.

- Northwest: 525 LOLH

- Basin: 43 LOLH

85% Scenario

If 85% of resources are built on time, WECC's analysis found 873 loss of load hours over the decade.

- Northwest: 706 LOLH

- Basin: 163 LOLH

- Rocky Mountain: 4 LOLH

67% Scenario

If only 67% of resources are built as planned over the coming decade, 2,144 hours may be at risk for loss of load across five subregions:

- Northwest: 1,294 LOLH

- Basin: 711 LOLH

- Rocky Mountain: 83 LOLH

- Mexico: 52 LOLH

- California: 4 LOLH

If resources are added as planned, loss of load may be limited to the Basin and Northwest subregions. However, if planned resource additions are delayed or cancelled, other subregions could also be at risk. In addition, 80% of the planned resource additions in Basin and Northwest, and more than half in Southwest, are categorized as Tier 3resources. Tier 3 resources are speculative, making it a risk to rely heavily on them to cover load growth.

Risks to Planned Resource Additions

Supply Chain Disruptions

Supply chain issues that surfaced during the pandemic in 2020 continue to affect the industry. Wait time for transformers and circuit breakers is between two and four years, and the cost of both has increased significantly, according to the Balancing Authorities. Switchgears and substation switches have seen delays, too. In addition, trade issues and geopolitical tensions have raised concerns about supply chain reliability.

Interconnection Queue

The interconnection queue continued to grow in 2024 and into 2025. On average, it took five years for a project built in 2023 to go from requesting an interconnection study to commercial operation . That is up from three years in 2015 and under two years in 2008. Although not all projects in the queue are built, capacity in an interconnection queue can be an indication of the magnitude of growth. Nationwide, the capacity in the queue reached 2,600 GW in 2023, more than double the installed capacity.

Siting Delays

Restrictions, including outright bans on siting renewable energy facilities, and controversy over specific energy infrastructure projects have become more common across the U.S . By the end of 2024, at least 459 counties and municipalities across 44 states had adopted restrictions on siting renewables. That is an increase of 16% in one year. The report also identified 498 projects in 49 states that faced significant opposition, a 32% increase.

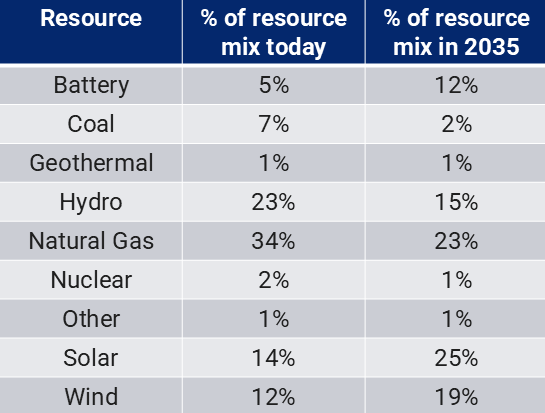

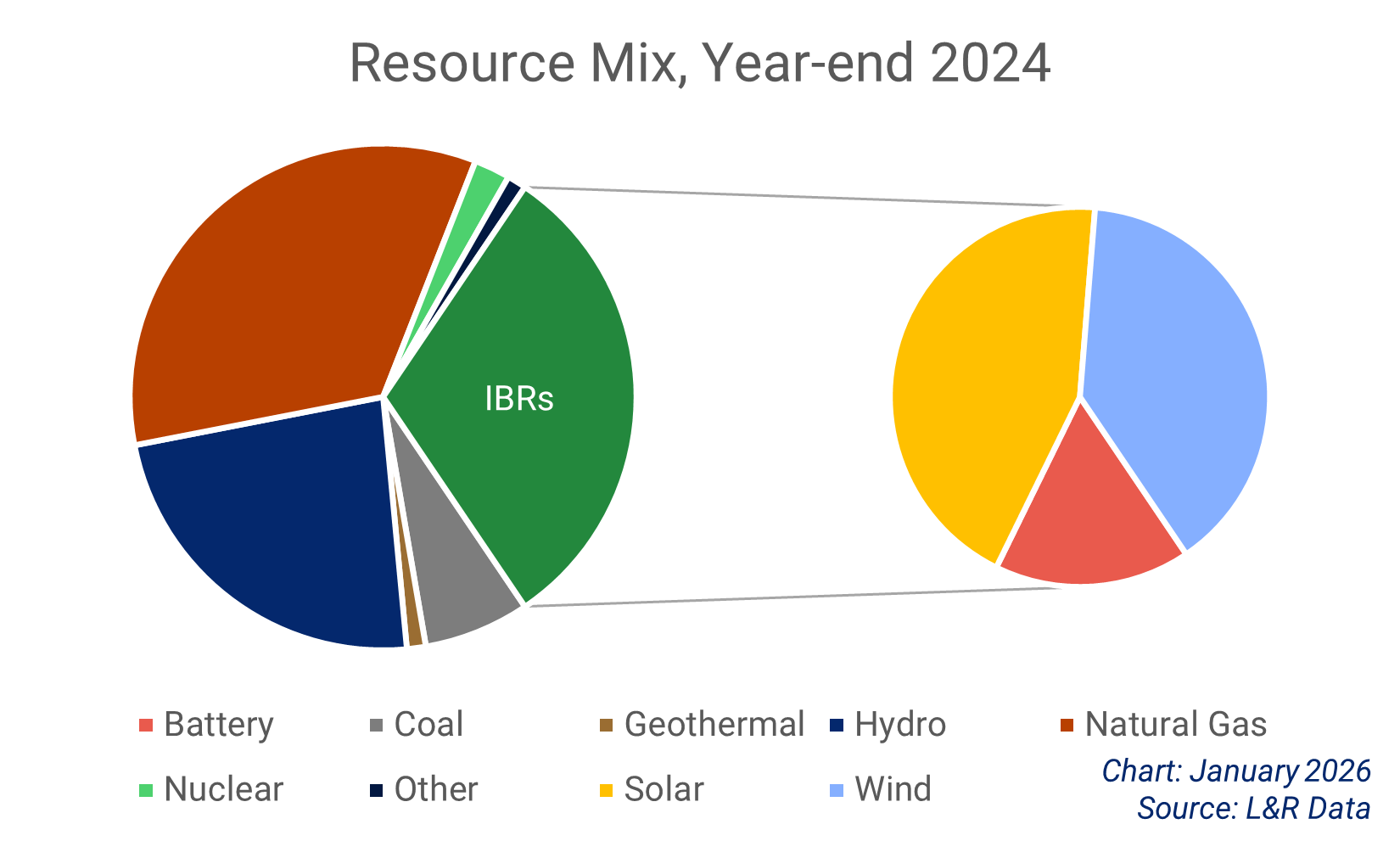

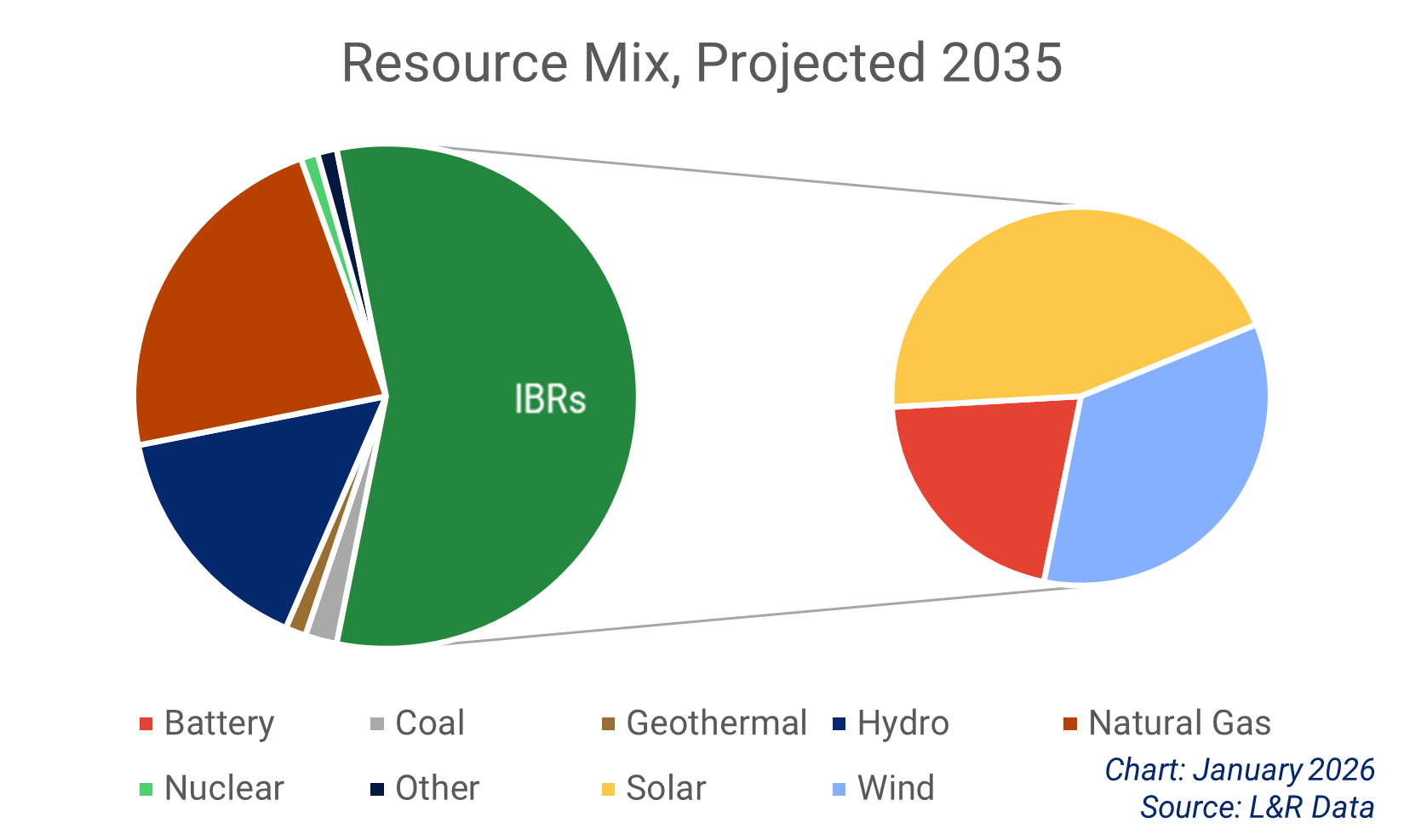

Resource Changes

While 177 GW of new resources seems sufficient to cover 31 GW of projected new load over the next decade, 90% of those resources are inverter-based resources (IBR).

These new resources, along with the retirements planned through 2035, continue the rapid evolution of the resource mix away from traditional dispatchable resources to more weather-dependent resources.

Inverter-based Resources

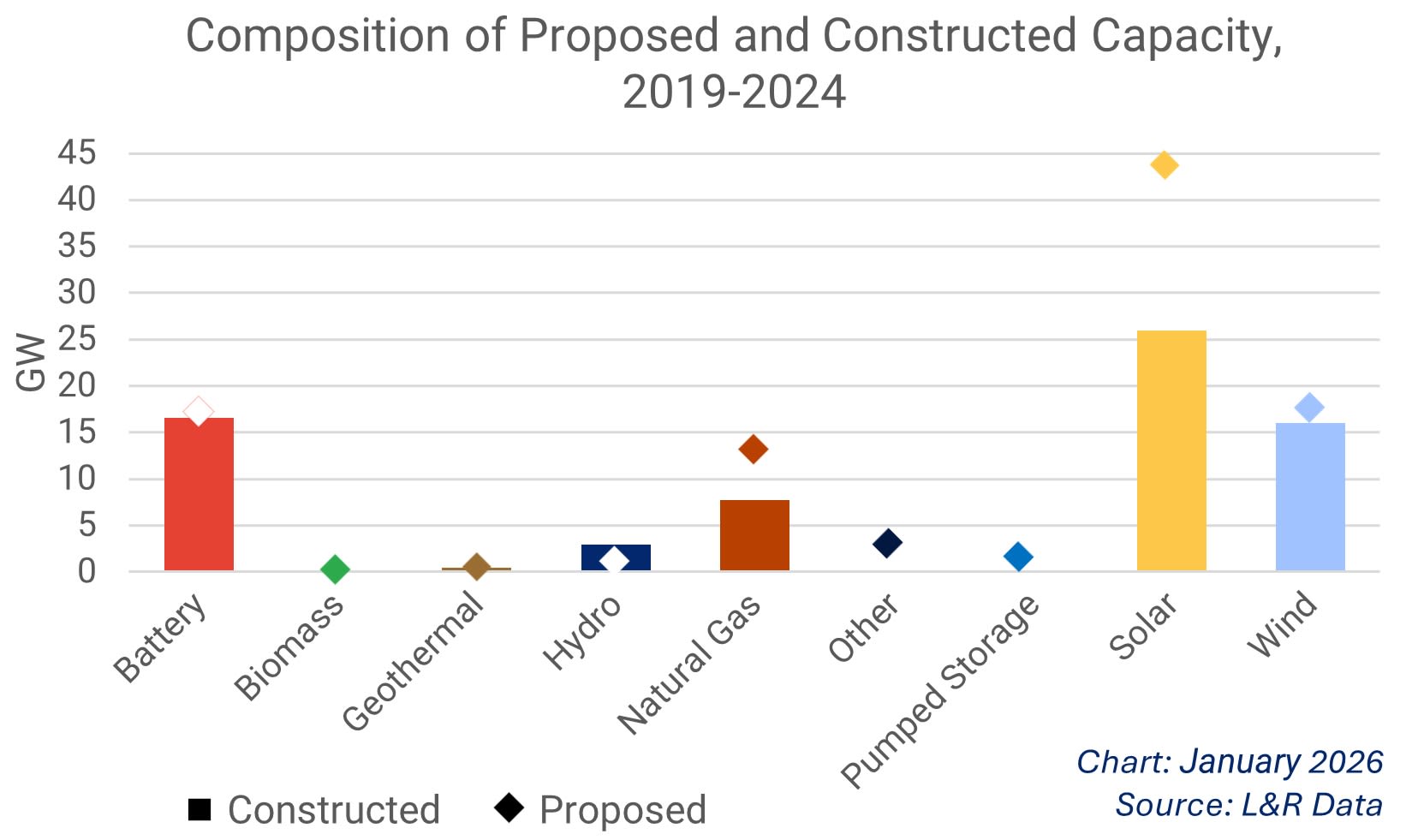

Of the 177 GW in planned resource additions over the coming decade, 90% are IBRs:

- 68 GW of solar capacity

- 55 GW of wind capacity

- 37.5 GW of battery storage capacity

Increasing Variability

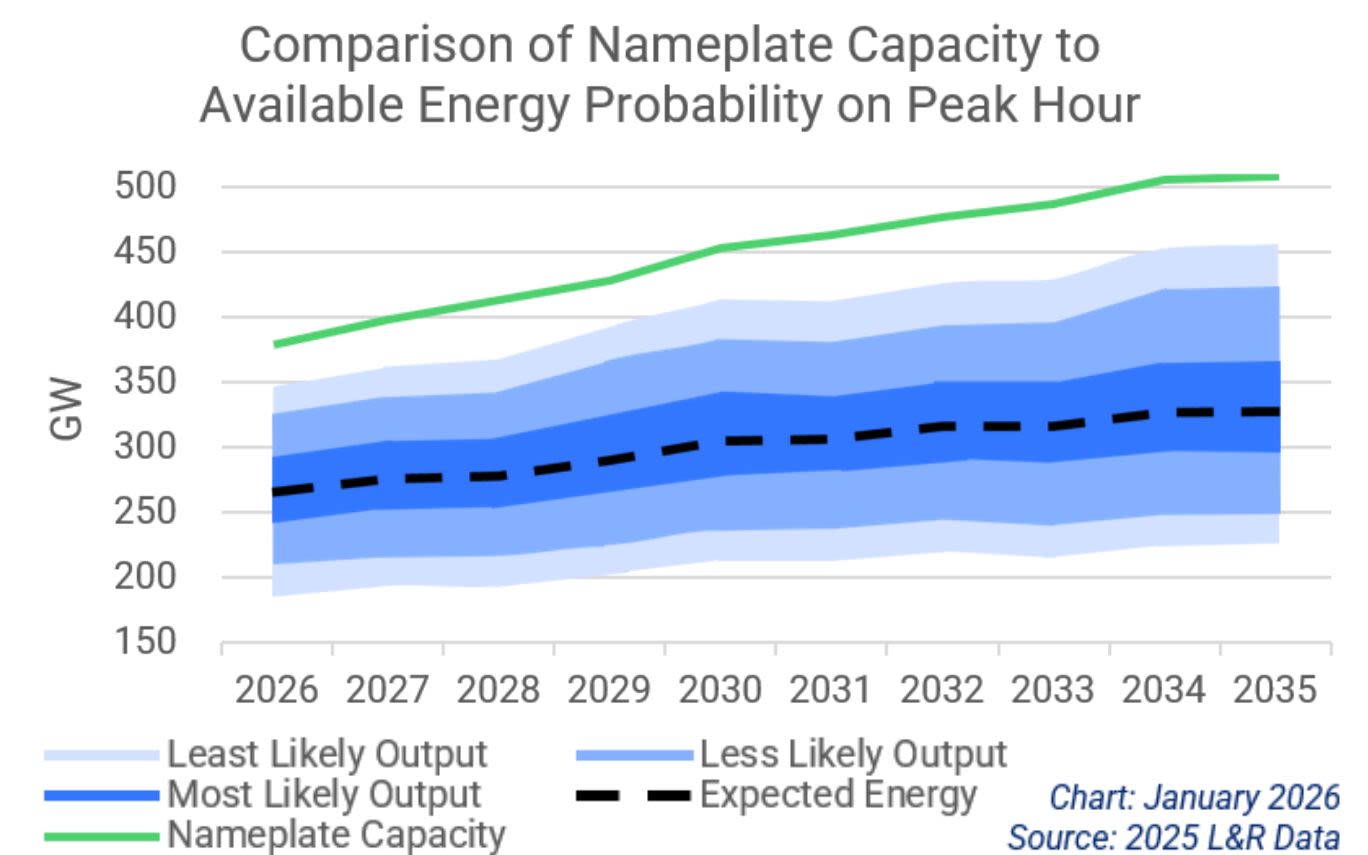

Given the significant increase in variable energy resources, efforts to determine resource adequacy must examine energy availability, as opposed to traditional resource planning in which nameplate capacity was the focus. IBRs do not generate electricity at nameplate capacity all the time, and their output can be weather-dependent. As a result, the expected energy of the resource mix is lower than its installed capacity. This gap will widen as more IBRs come online and dispatchable resources retire.

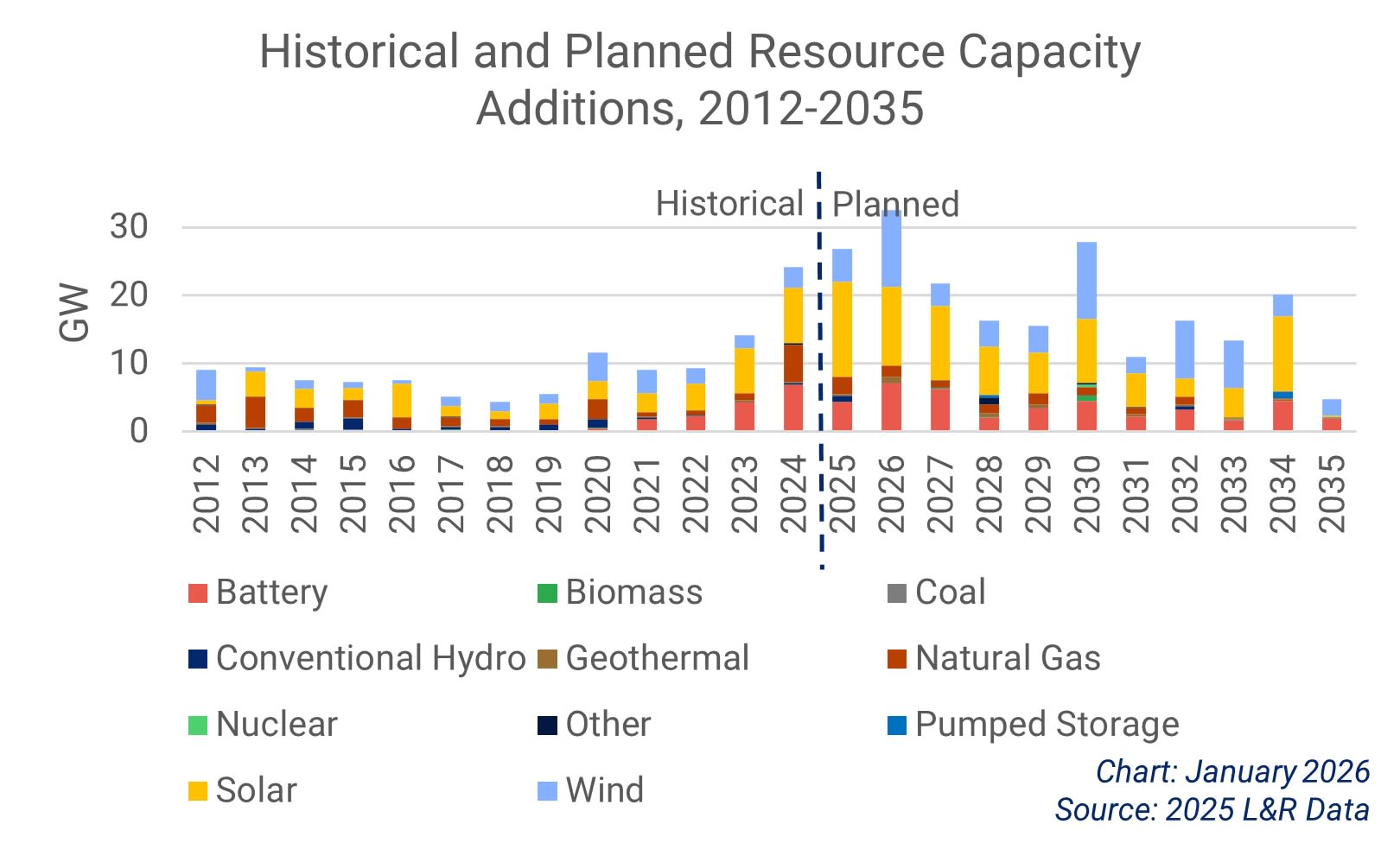

Resource Additions

Planned Resource Additions

Of the 177 GW expected to be added in the Western Interconnection over the decade, 32 GW are planned to be built in 2026. This is over three times the historical resource build average of 10 GW per year for 2015 through 2024. During that time, the greatest resource buildout occurred in 2024, with 24 GW of new resources built.

In addition to the IBRs planned, 9 GW of natural gas capacity is expected to be added over the decade, while 0.3 GW of nuclear is listed in current resource plans.

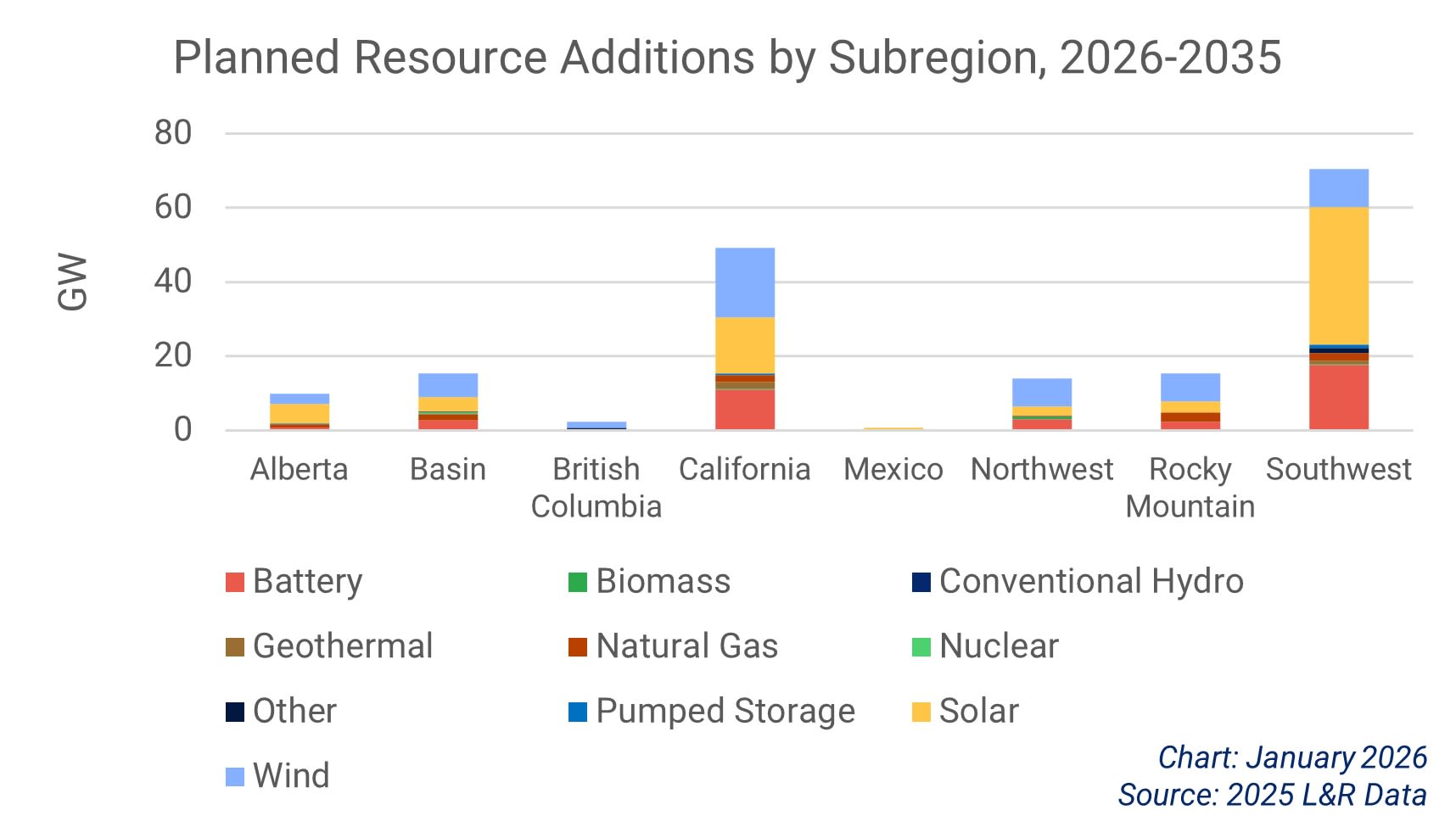

Subregional Breakdown

Almost 70% of the planned resource additions are in two subregions: Southwest (70 GW) and California (49 GW).

Basin, Northwest, and Rocky Mountain subregions each have about 15 GW in planned additions over the coming decade. The Mexico subregion has 600 MW of solar planned.

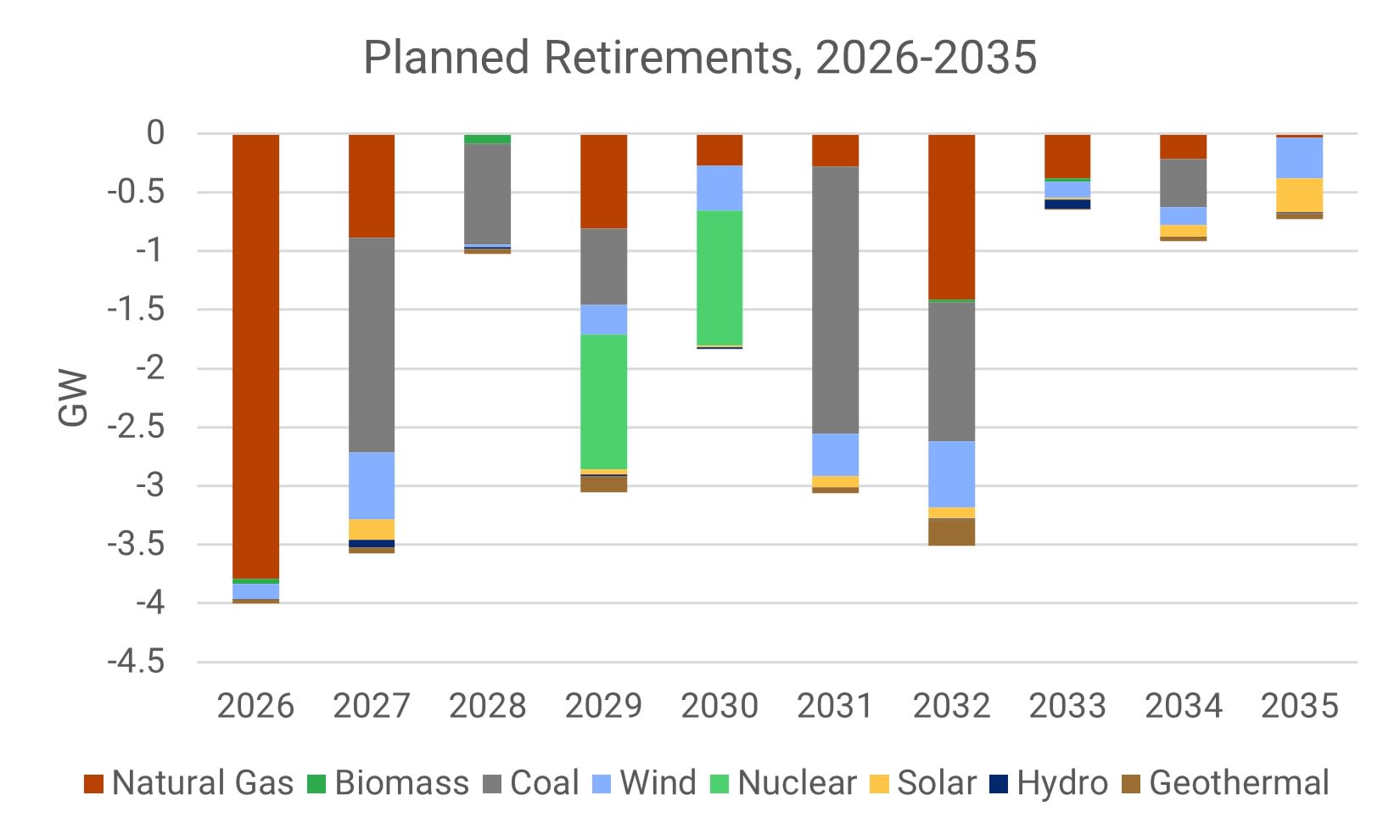

Resource Retirements

Planned Retirements

Entities plan to retire 22 GW of generation over the next 10 years. The vast majority is baseload generation such as coal (7 GW), natural gas (8 GW), and nuclear (2.3 GW, Diablo Canyon's two units, in 2029 and 2030).

Resource Mix

If all retirements and resource additions are made as planned, more than half of the total resource mix in 2035 will be IBRs. The expected energy output of the projected future resource mix is much lower than the nameplate capacity and fluctuates based on weather. This creates uncertainty, which increases resource adequacy risk.

Adding 32 GW of nameplate capacity in one year seems implausible as there is only one year in the last decade in which more than 20 GW were added.

Load Scenario Analysis

Much of the projected load growth in the Western Interconnection is attributed to large loads. If they materialize as predicted, or greater, the resource adequacy risk grows. However, large-load growth is an uncertain and rapidly changing landscape. Some large load additions may not materialize, while new projects could appear with little notice, making planning for future load growth complicated.

The accuracy of load forecasts is critical for the planning and reliable operation of the bulk power system, helping to ensure there is sufficient supply to meet demand. In this year's Western Assessment, WECC examined the impact if load forecasts are under or over estimated.

Uncertainty related to large loads is growing in the West, with questions about whether they will arrive as forecast, or beyond, or whether the projections over estimate their impact.

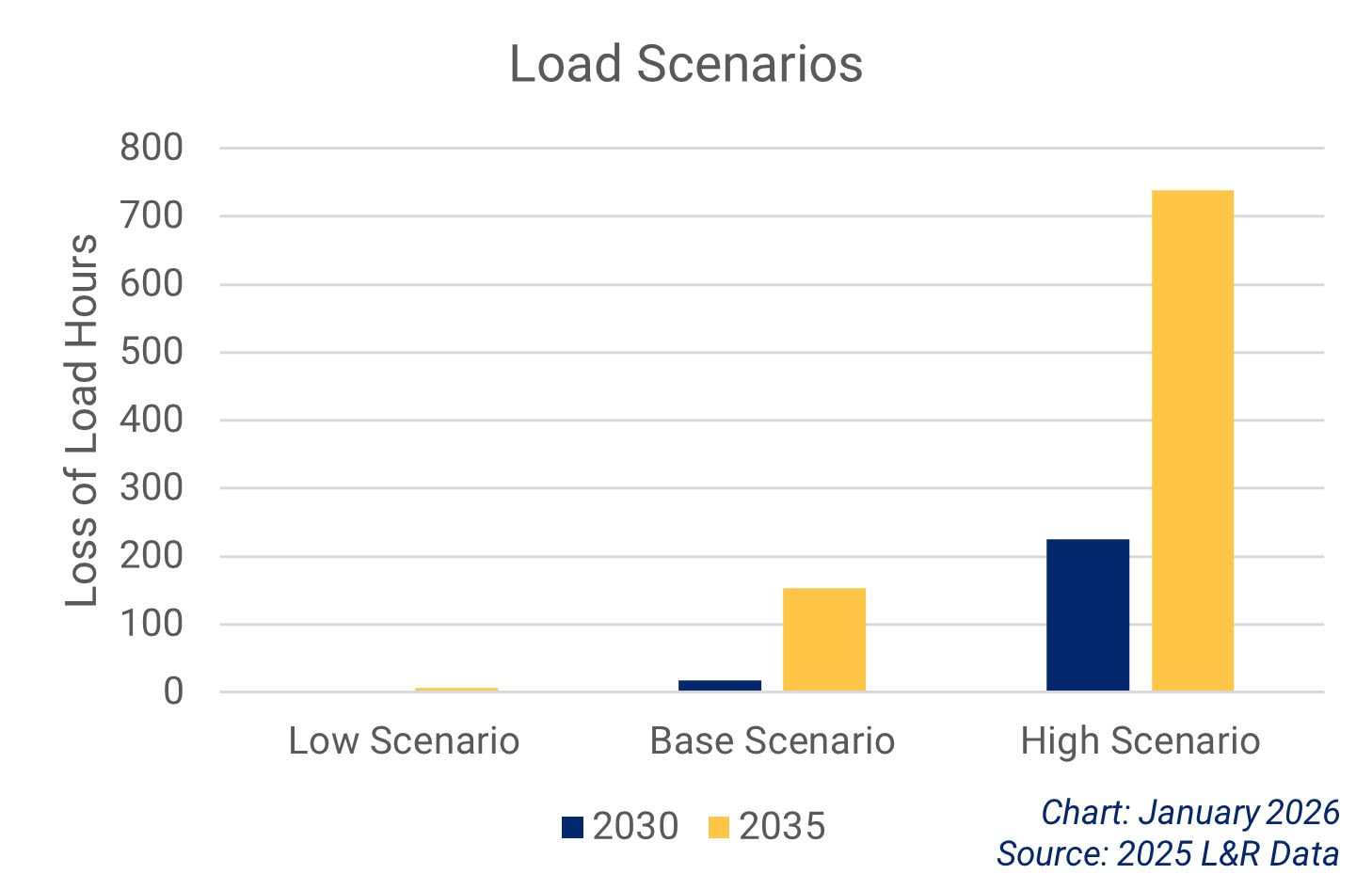

To account for this uncertainty, WECC examined three load scenarios in 2030 and 2035. In all the scenarios, it is assumed that 100% of the planned resources come online as submitted, including a large amount of speculative resources.

- Base Scenario: Examined demand growth as forecast

- Low Scenario: Load forecasts were reduced to examine the possibility that some large-load projects do not materialize

- High Scenario: Load forecasts were increased to incorporate some speculative large-load increases (not included in the base scenario), as provided by balancing authorities

The interconnection saw loss of load in the Base Scenario, and the loss of load hours increased significantly in the High Scenario. More notably, even if the demand is lower than expected and all resources are built as planned, resource adequacy risk is not completely mitigated.

Load Growth

Over the next decade the Western Interconnection is forecast to experience significant load growth due to drivers like electrification, population increases, and large load expansion.

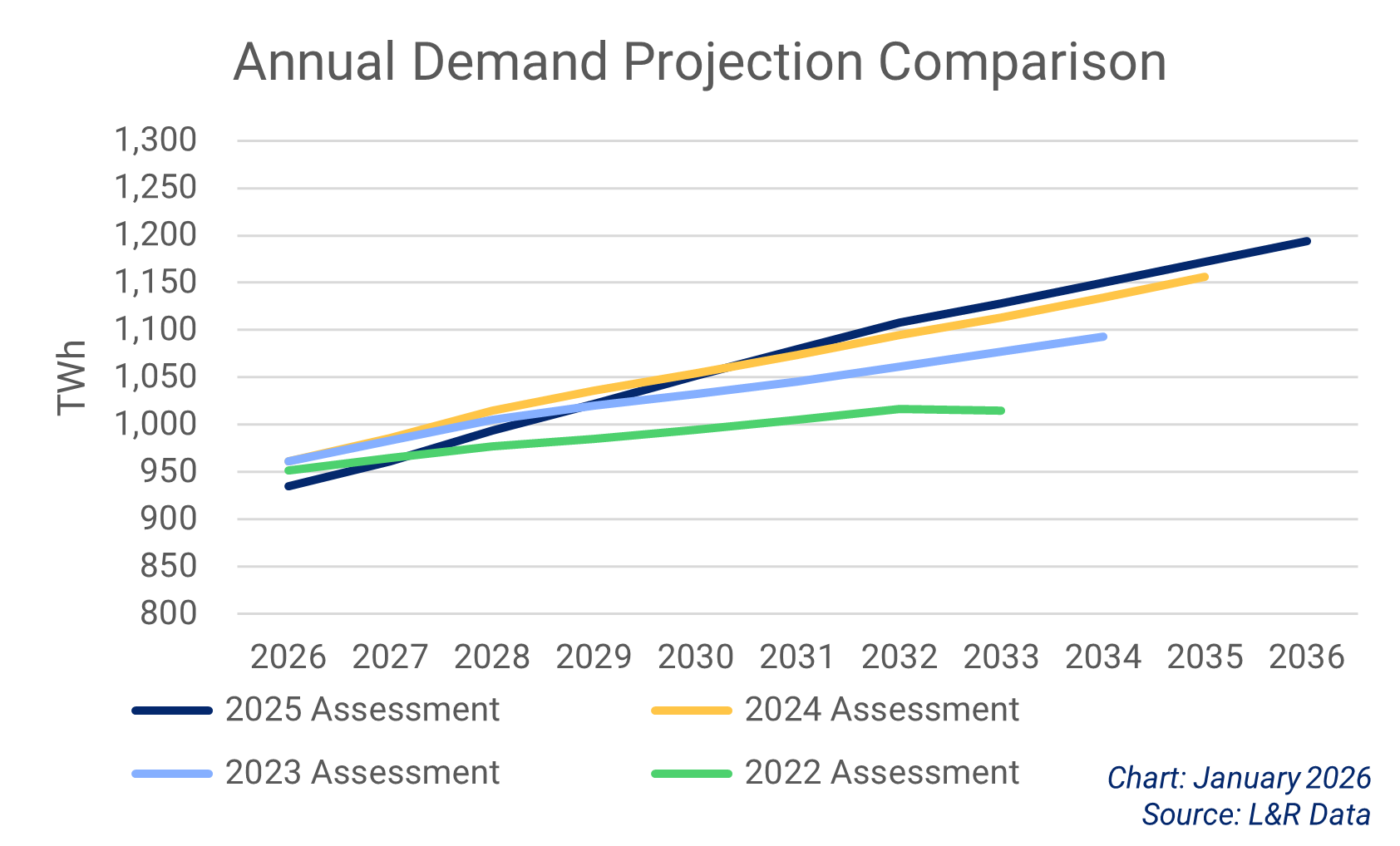

Annual Demand

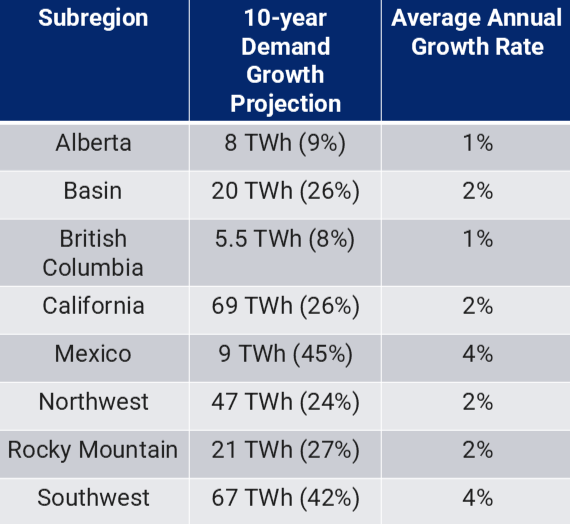

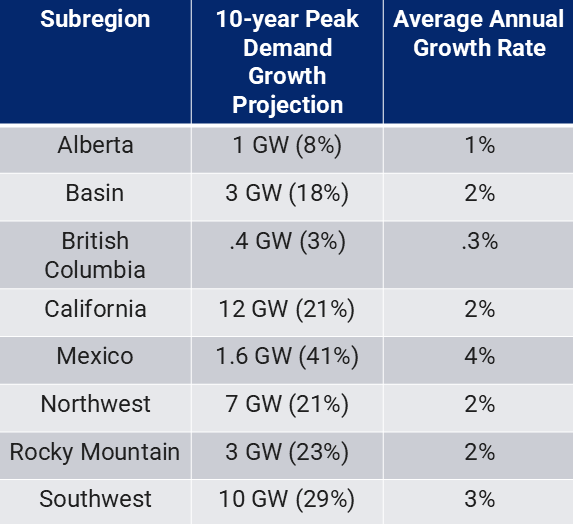

Demand for electricity across the Western Interconnection is expected to grow 25% over the next 10 years, with two of the eight subregions projected to see increases of more than 40%. Four other subregions are projected to see demand increase over 20%. A year ago, load forecasts indicated a 20% increase in demand over the decade.

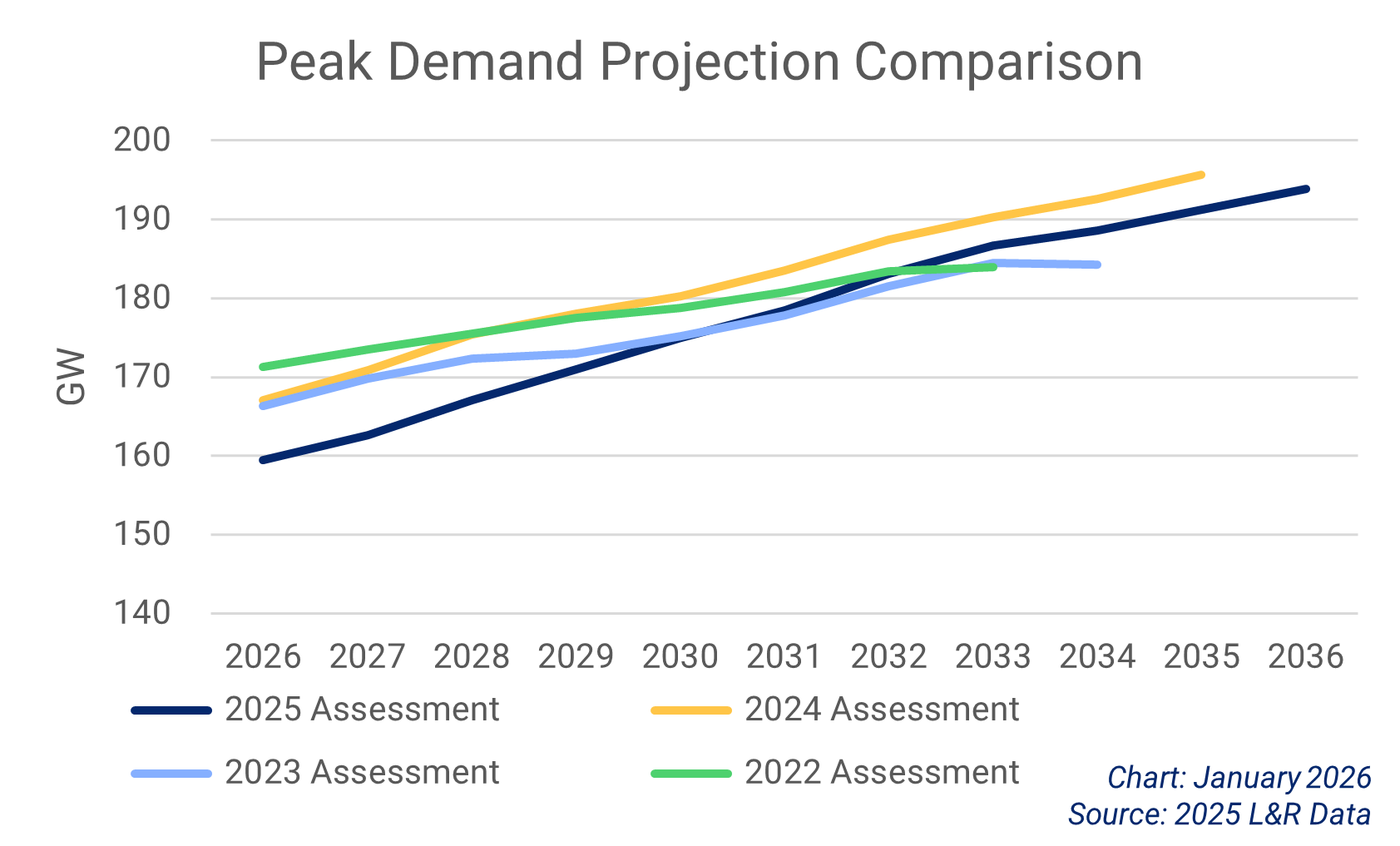

Peak Demand

Peak demand in the Western Interconnection is expected to grow 20% over the next decade, from 160 GW in 2026 to 191 GW in 2035. Peak demand values, while projected to increase over the next 10 years, are not as high as projected in 2024. Several subregions are projected to see peak demand grow significantly more than the interconnection-wide average.

Load forecasts continue to show significant growth over the next decade following similar projections in the 2024 Western Assessment. While utilities must ensure they have enough energy to meet projected load, load forecasting certainty is not the same as it was several years ago because of speculative large loads, primarily data centers and AI. It may be necessary for utilities to change the way they forecast demand growth.

Methods & Data

- This year's Western Assessment uses eight new subregional boundaries that better align with operational and planning realities, and are consistent with other WECC assessments.

- This assessment uses Loads & Resources data provided by the Balancing Authorities in early 2025.

- For more information on the methodology used in the scenarios, a glossary, and profiles of the subregions, read the 2025 Western Assessment Supplemental Information.