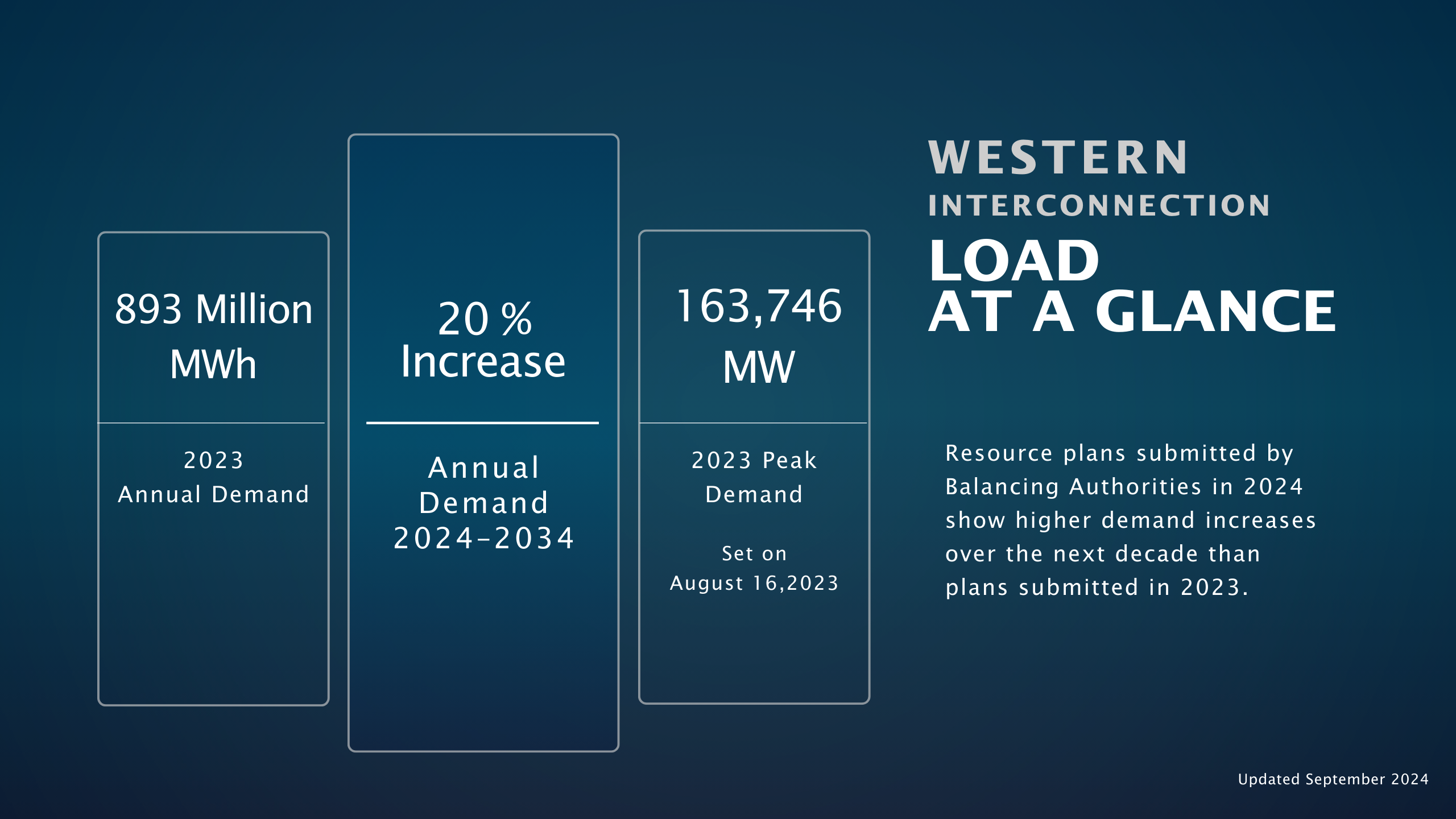

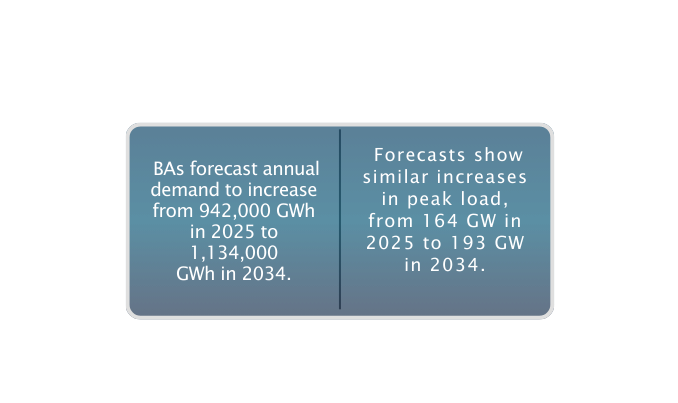

Load

Demand for electricity is expected to grow, and demand peaks are no longer predictable

As recently as a decade ago, the supply and demand for electricity was fairly predictable. Today, forecasting demand has become more difficult due to a variety of factors, including more severe weather, the growth of distributed energy resources, and policies that encourage electrification of homes, buildings, and transportation. Not only is demand in the Western Interconnection growing, it is also becoming more variable.

A 2023 study by Grid Strategies found that, nationwide, grid planners had nearly doubled their five-year load growth forecast over the last year, from 2.6% to 4.7%. Manufacturing, industrial growth, and data centers are the primary drivers of the increase.

In the Western Interconnection:

- Puget Sound Energy's 2028 forecast increased nearly 11%, from 4.4 GW to 4.9 GW.

- Arizona Public Service's 2028 forecast also increased by almost 11%, from 8.6 GW to 9.5 GW.

- Portland General Electric nearly doubled its five-year summer peak demand growth forecast, from 275 MW to 525 MW.

Electrification policies are expanding in the interconnection

Electrification will bring a number of changes to the Western Interconnection and will present challenges to planning and operating the bulk power system. One study in 2022 found that electric vehicle adoption could increase peak demand in the Western Interconnection by 25% by 2035. Another 2022 study by the Electric Power Research Institute that examined the impacts of electrification on Seattle City Light found that a 100% electrification scenario for the transportation sector would require 90 times more electricity to fuel electric vehicles than is needed today. Under the 100% electrification scenario, the utility's summer peak in 2030 is projected to be 2,480 MW, compared to 1,424 MW in 2020. Under the same scenario, the winter peak in 2030 is projected to be approximately 4,605 MW, compared to 1,739 MW in 2020.

Four western states have statewide electrification policies. In addition, 111 cities have adopted policies that require or encourage electrification of buildings.

California

The state banned the sale of gas heating and water heating equipment starting in 2030. In addition, the state adopted a ban on the sale of gas-powered vehicles starting in 2035.

Colorado

By 2030, the state plans to have 940,000 light-duty electric vehicles, with 100% zero-emissions vehicles by 2050.

The state aims to reduce economy-wide greenhouse gas emissions by 50% from 2005 levels by 2030. This will require electrification of multiple sectors. The state's Building Performance Standards require owners of certain types of property to reduce emissions and meet energy use performance targets.

Oregon

The state Legislature adopted targets requiring 25% of registered vehicles and at least half of new vehicles to be zero-emission vehicles by 2030. The target increases to 90% of new vehicles by 2035.

HB 2021 requires investor-owned utilities to reduce GHG emissions to 100% below 2010-2012 baseline levels by 2040. Electrification will play a significant role in reaching these targets.

Washington

The 2019 Clean Energy Transformation Act requires a GHG-free electric supply by 2045. The state Legislature set targets for a reduction of energy consumption in new buildings. In addition, beginning in March 2024, the state’s building code will favor the use of electric heat pumps over natural gas heating in new residential and commercial construction.

Load growth increases in the Pacific Northwest: Data centers spur load growth at Grant County PUD

The 2023 Northwest Regional Forecast projects a 20% increase in load in the region over the next five years reflecting a "markedly different trajectory than past forecasts." Much of the expected growth in the 2023 forecast is attributed to new industrial customers' solidifying plans and schedules for development. Utilities plan to add more than 11 GW of new generation in the next five years, most of which will be wind, solar, and battery storage projects to meet the new demand, in addition to emission-reduction goals. This is an increase of nearly 3 GW compared to the 2022 forecast.

Load in Grant County PUD in central Washington has grown significantly in recent years, primarily due to an influx of data centers and crypto-mining facilities. The utility has seen growth in these large load centers for a decade, and more is on the way. The first data center arrived in the area a decade ago, but the utility now receives three to five inquiries a week from data center operators interested in locating in its service territory. Attracted by low rates, relatively inexpensive land, a robust fiber-optic network, state tax incentives, and reliable electric service, data centers ramped up their arrival in cities such as Moses Lake, Royal City, and Quincy when COVID hit in early 2020. The interest has held steady in recent years as companies seek more capacity for artificial intelligence applications.

Grant County, which serves more than 53,000 customer meters in the predominantly agricultural region, is working to keep up with the growth—actively planning several new transmission lines, building two to three new substations annually, and upgrading existing substations.

Today there are seven data centers in Grant’s service territory, with a combined load of about 260 MW, and 10 crypto-mining facilities, with a combined load of about 30 MW. There are another 2,000 MW of load in the queue, half of which are data centers and the rest are mostly EV anode battery manufacturers. There is no moratorium on growth at the utility, but the infrastructure cannot handle the load required by a new data center. The wait is 7–10 years, according to Shane Lunderville, Business Development manager with the utility’s Large Power Solutions department. “But they are willing to wait,” he said.

Grant County PUD has gone from selling a significant portion of the output from its two hydropower facilities, which have a combined nameplate capacity of more than 2,000 MW, to seeking additional generation, including solar farms, hydrogen storage, and small modular reactors.

The utility has seen annual large-load growth of 5–7% for the last decade and hit a peak of nearly 1,000 MW in summer 2023. That’s up from a peak of 697 MW in 2012.

“We’re definitely in a unique situation here,” Lunderville said.